What is Sustainability Intelligence?

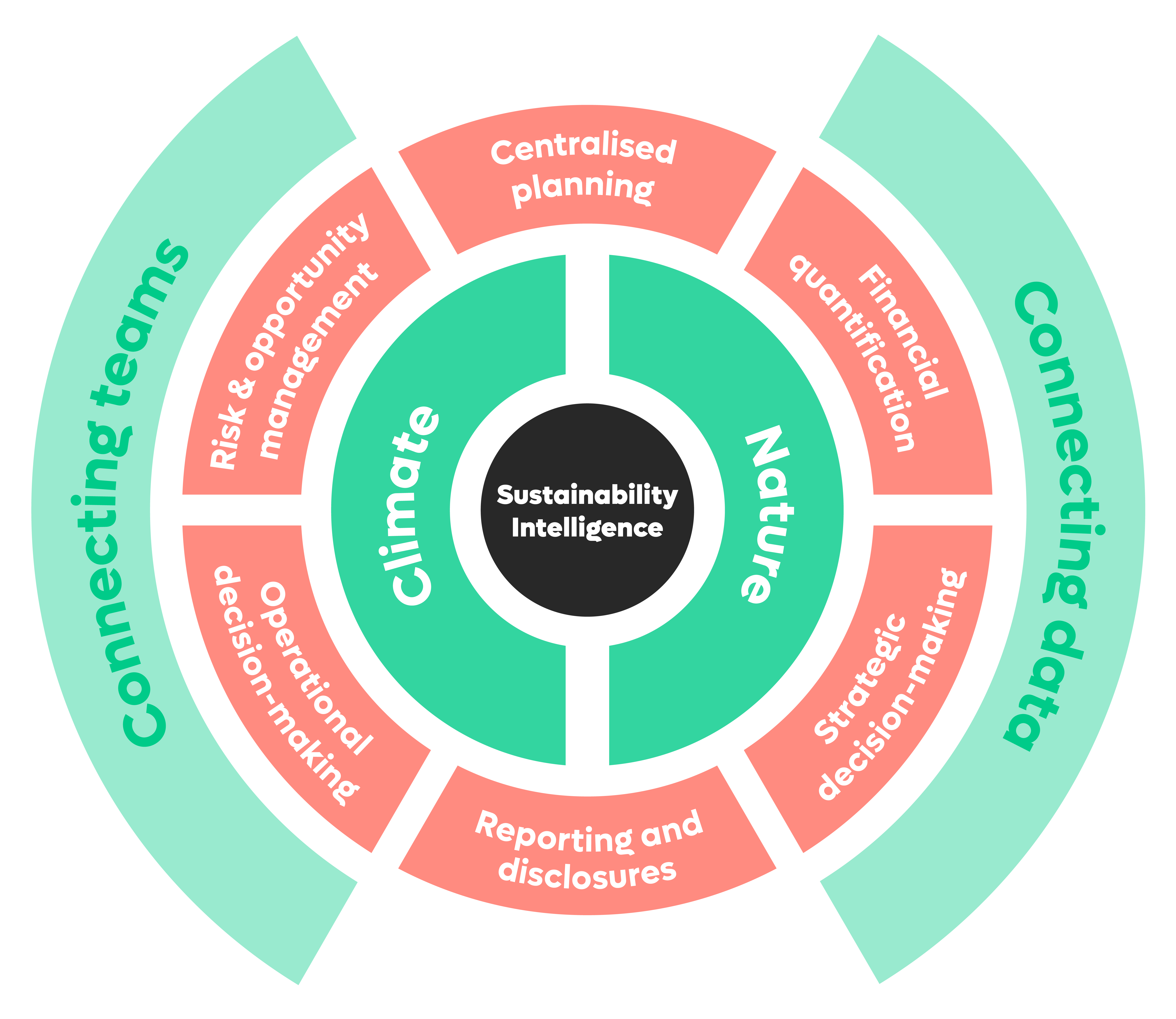

Sustainability Intelligence is the confluence of climate and nature analytics, data, technology and information flows that enables business to become profitably sustainable.

Why do businesses need sustainability intelligence?

Sustainability strategy and decisions now operated in an increasingly complex environment. Nature now needs to be considered alongside climate, regulatory pressures are increasing exponentially and sustainability needs to be embedded into the wider business in order to be successful. Having a joined up view of all of the component parts of sustainability will be critical to an organisations ability to deliver a profitably sustainability strategy.

How is it different to what exists today?

For the most part, sustainability has been tackled as a series of projects across various teams. Consultants deliver reporting, risk teams manage risks with consultancy or point solutions and sustainability teams manage net zero plans and carbon reduction strategies and more recently nature reduction strategies, often with siloed teams. This fragmented approach to tackling the interrelated challenges often means that sustainability is operating within a fragmented environment within global corporates. Sustainability Intelligence aims to remove the barriers and connected all the elements needed to deliver an embedded sustainability strategy that can deliver on sustainability and profitability goals for the organisation.

What are the main benefits of sustainability intelligence?

In short, Sustainability Intelligence results in joined up and embedded sustainability strategy that leads to better decisions, strategies and outcomes for both the sustainability goals and the wider business goals. It brings together climate, nature, risks, opportunities, financial impact into a centralised view that breaks down silos.

Is it difficult to implement?

Sustainability Intelligence leans on technology, data and people to provide this valuable connected view. As with any company-wide view there will be a sharing and connecting of data. Companies can choose to build this in-house or leverage a platform that is built for purpose such as Risilience.

Will I need company-wide buy in for sustainability intelligence?

Ultimately yes, however this can be done in stages. One of the benefits of Sustainability Intelligence is that it connects sustainability strategy with business strategy, making sustainability business cases easier to create and easier to get buy-in for investment once financial impact analysis and a full view of all the factors including physical and transition risks and opportunities are considered.

As a sustainability leader what will this mean for me?

Sustainability Intelligence provides CSOs with the tools to co-ordinate internal progress, measure and monitor climate and nature impacts, identify opportunities to reduce impacts, build resilience, and engage with stakeholders. Getting buy-in for Sustainability plans is often a key barrier for sustainability leaders and sustainability intelligence arms these leaders with the insight, language and tools to build successful business cases.

As a finance leader what will this mean for me?

Traditionally, the Chief Financial Officer’s (CFO) primary responsibilities have centered around financial management, reporting, risk mitigation and strategic decision-making to enhance shareholder value. However, as environmental, social and governance considerations have gained prominence, the CFO’s role has expanded to include sustainability-related aspects. A CFO could leverage the analytics provided by Sustainability Intelligence to support financial planning and analysis, risk management and compliance, capital allocation and investment decisions, and financial reporting and disclosure.

As a Risk leader what will this mean for me?

Increasingly, CROs are expected to integrate risks from climate and nature into the organisation’s enterprise-risk management framework. To this end, the CRO is responsible for enterprise-risk management, ESG risk integration, strategic-risk assessment, insurance and risk transfer, crisis management and business continuity.