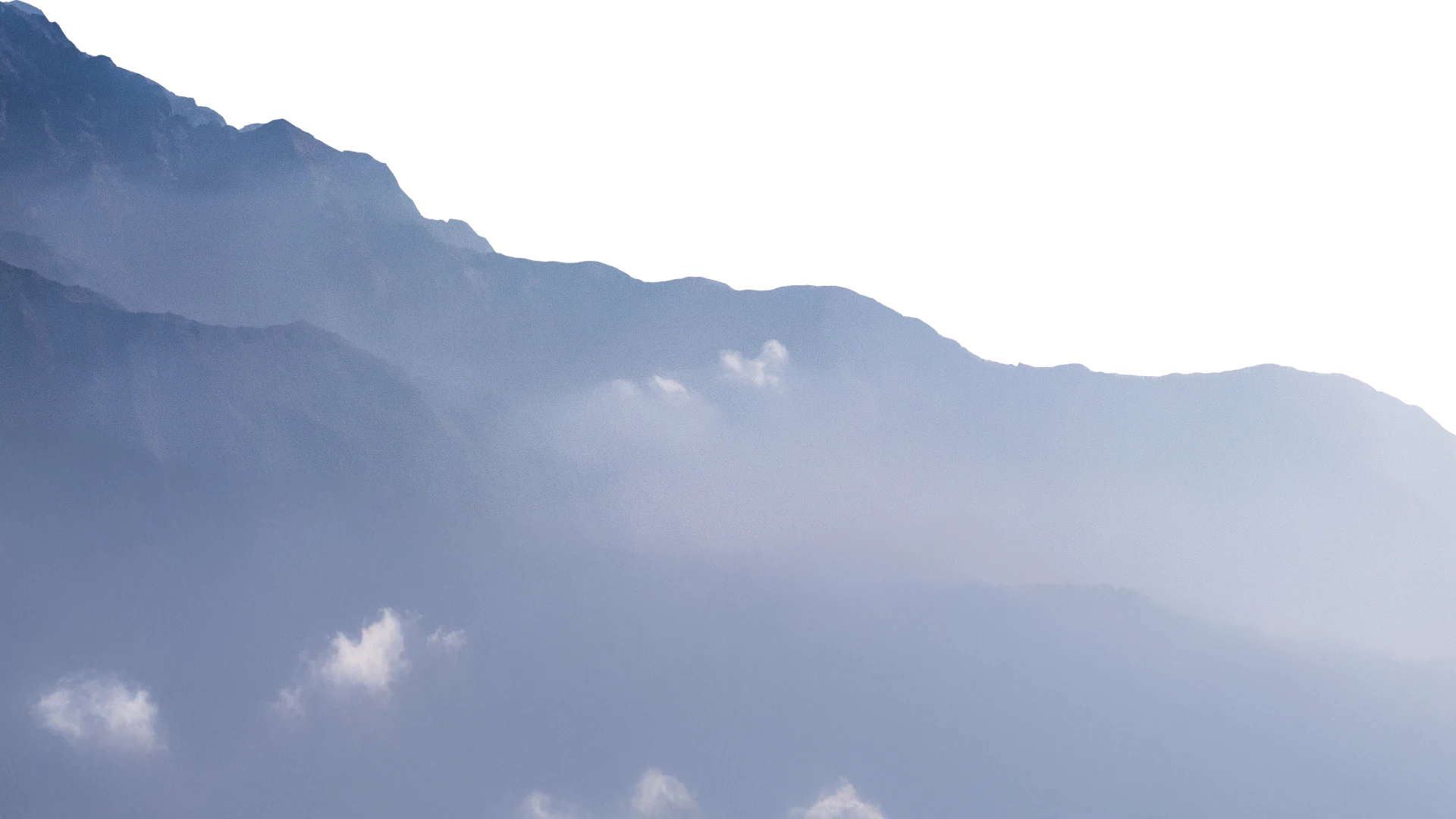

Climate and nature risk is business risk.

The Risilience-powered platform, Riise, delivers financially-quantified analytics to turn risk into business opportunity.

Turn climate and nature-related risks into actionable insights

Risilience empowers global finance, sustainability, and risk teams to quantify, plan, and act on the financial impacts of climate risks – driving transformation and competitive advantage in a low–carbon economy.

The Riise platform uniquely assesses both physical and transition risks through a single lens, enabling companies to identify high–ROI decarbonisation opportunities and integrate sustainability into strategy.

How we help

Riise translates climate-and-nature-related risk into decision-grade metrics that business leaders can act on.

With a unique capability to assess both physical and transition risks through a single analytical lens, Riise supports corporate transformation to succeed in a low-carbon economy.

Understand where decarbonisation initiatives bring the best ROI for your organisation and integrate sustainability strategically to establish a competitive advantage.

-

01.

01.Quantify

Build a stronger foundation for reporting, disclosures, and strategic decision-making.

-

02.

02.Strategise

Understand climate and nature risk exposure in financial terms to clearly and confidently drive strategic decision-making.

-

03.

03.Deliver

Turn strategic decisions into financially informed, measurable actions for sustainable growth.

Who we help

Riise delivers insights to support global corporate teams across finance, sustainability and risk to quantify, strategise and act on the financial impacts of climate-and-nature-related risks and opportunities.

Riise equips ESG advisory teams at financial institutions, across due diligence, operations and sustainability, with the insights to assess and act on the financial implications of climate- and nature-related risks and opportunities.

Corporates

Reporting and disclosure

Meet reporting commitments

Secure business insights by meeting reporting commitments across multiple jurisdictions and standards, with science-led rigour and credibility.

Advisory services

Flexible support services

An unrivalled and multidisciplinary team of experts is available to help you at any point along your sustainability journey.

Strategic decision support

Empower your teams

Empower and connect teams across the business to drive implementation of sustainability initiatives for commercial success.

Transition planning and insights

Deliver effective plans

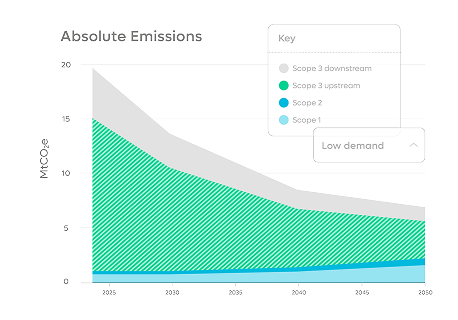

Quantify and strategise for both climate-and-nature-related physical and transition risks to deliver a transition plan aligned with business strategy.

Reporting and disclosure

Secure business insights by meeting reporting commitments across multiple jurisdictions and standards, with science-led rigour and credibility.

Advisory services

An unrivalled and multidisciplinary team of experts is available to help you at any point along your sustainability journey.

Strategic decision support

Empower and connect teams across the business to drive implementation of sustainability initiatives for commercial success.

Transition planning and insights

Quantify and strategise for both climate-and-nature-related physical and transition risks to deliver a transition plan aligned with business strategy.

Financial

Banks

Meet reporting commitments

Investment Bank ESG Advisory teams are at the forefront of guiding clients through the complex and rapidly evolving sustainable finance landscape.

Private equity

Flexible support services

Private Equity (PE) firms operate with a long-term investment horizon and a hands-on approach to value creation.

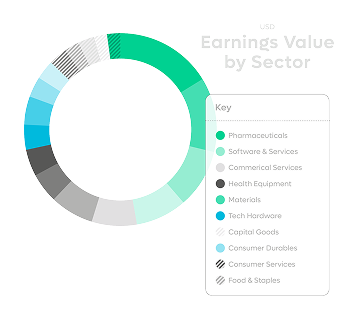

Asset management

Measure impact for stakeholders

Asset managers face increasing pressure to deliver strong, risk-adjusted returns while navigating a complex and rapidly-evolving investment landscape.

Banks

Investment Bank ESG Advisory teams are at the forefront of guiding clients through the complex and rapidly evolving sustainable finance landscape.

Private Equity

Private Equity (PE) firms operate with a long-term investment horizon and a hands-on approach to value creation.

Asset management

Asset managers face increasing pressure to deliver strong, risk-adjusted returns while navigating a complex and rapidly-evolving investment landscape.

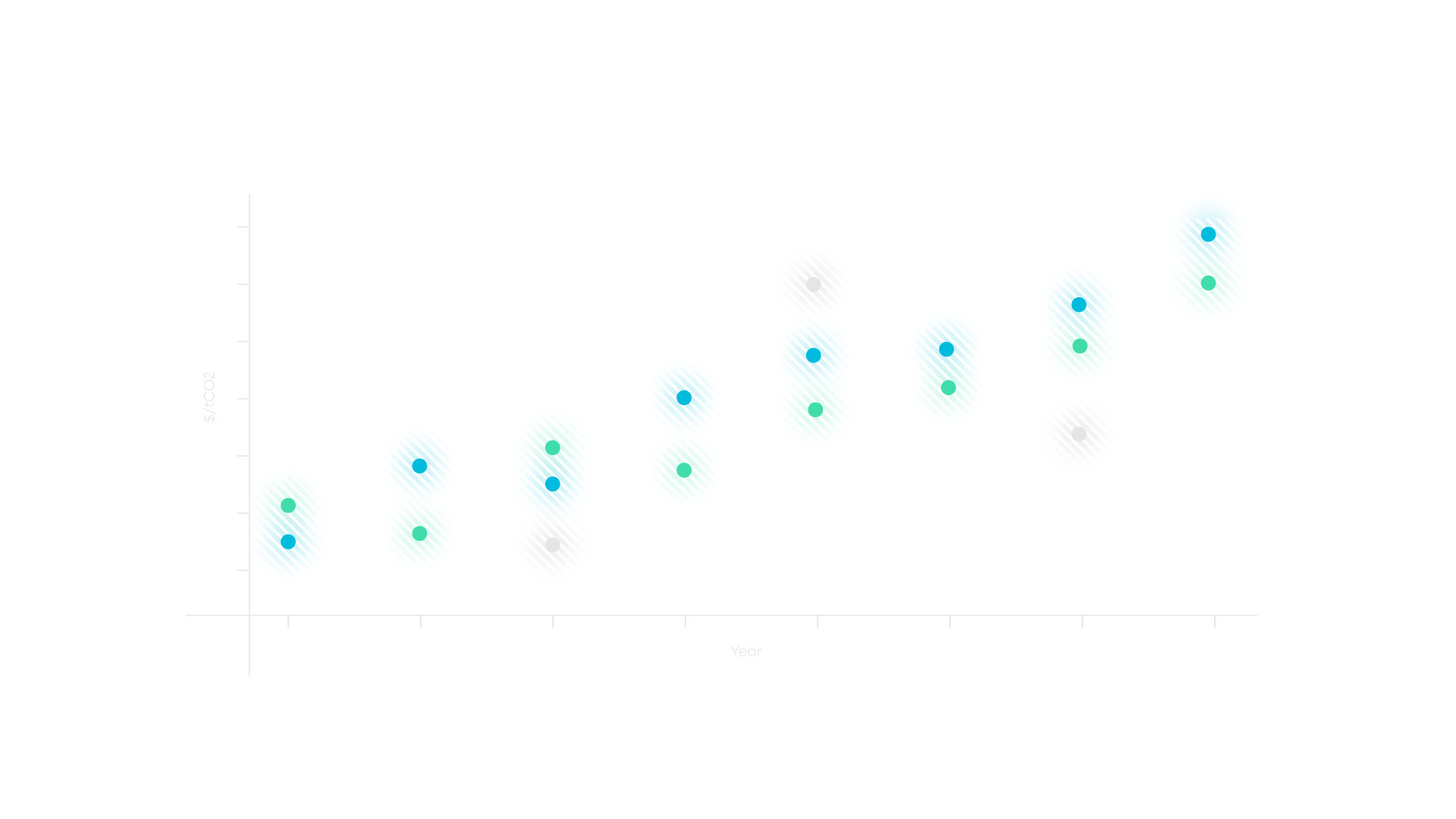

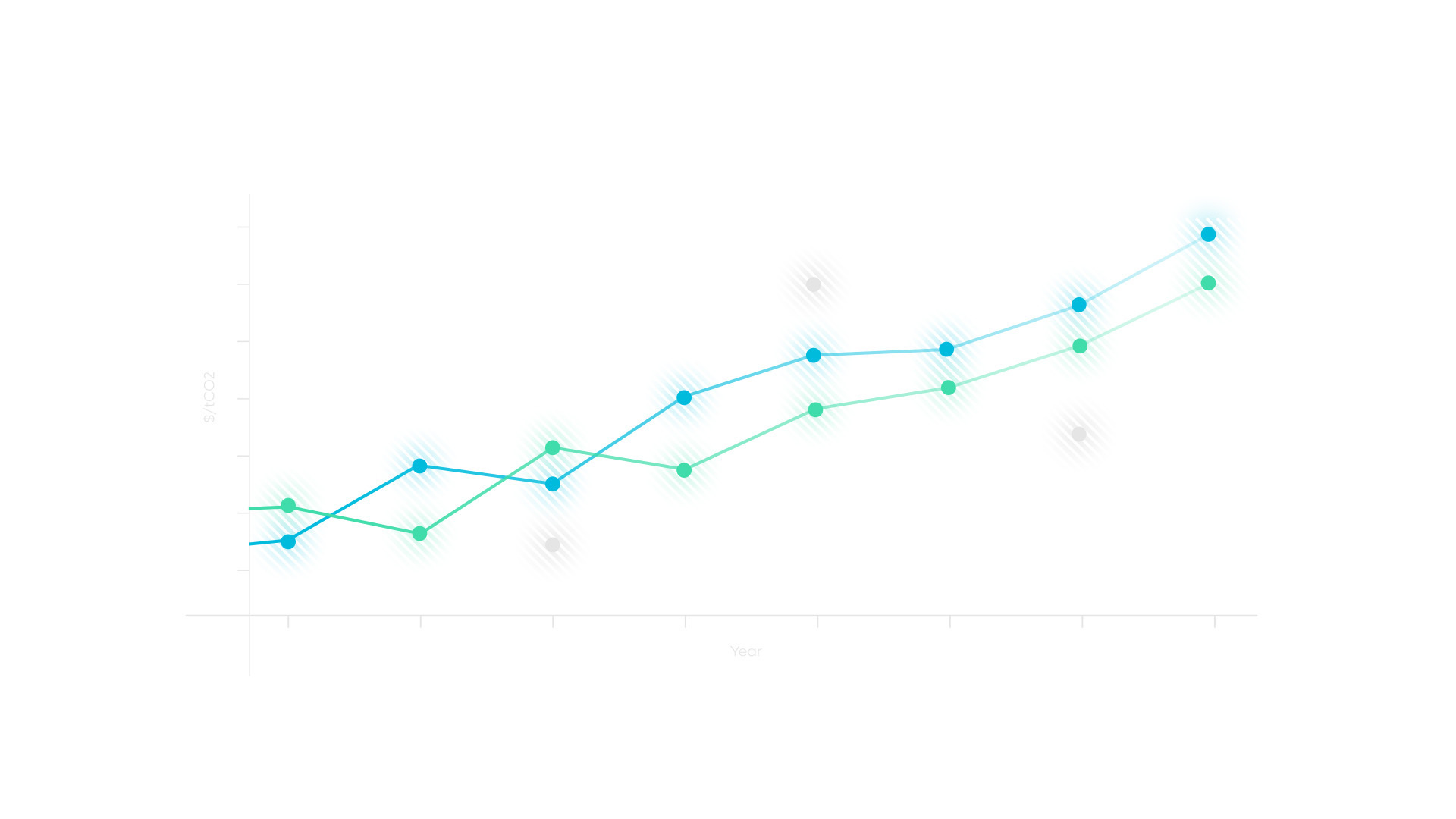

Business risk in numbers

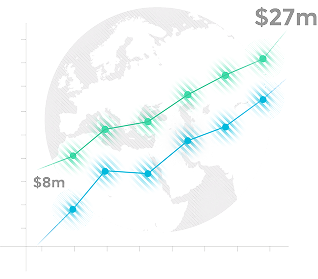

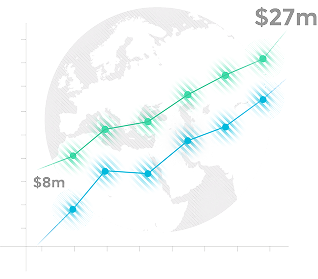

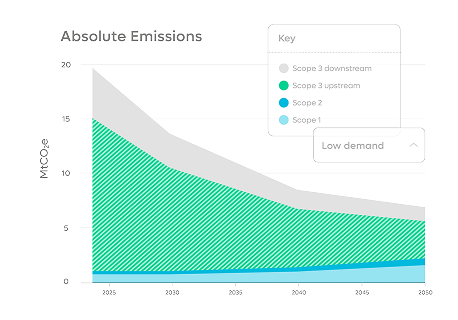

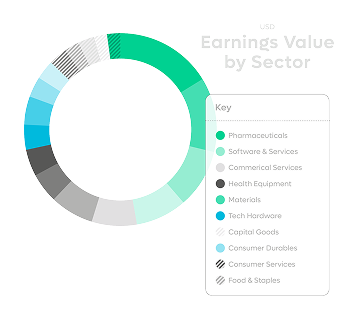

50% of corporate earnings are at risk over a 10-year period from climate-related transition risks in a Paris-Aligned (Net Zero) climate scenario

60% of the total climate-related risks across the global economy is represented by the utilities, food and beverage, energy and materials sectors that have the highest transition-related risks

$244/tCO2 estimated global average price of carbon in 2030 in a Paris-Aligned (Net Zero) climate scenario

Latest resources

January 2026: New Risilience analysis shows climate-related transition risks are the most immediate threat facing global organisations.