Disclosure as Strategy: Aligning Climate Risk with Financial Performance

Leading organisations are moving beyond regulatory box ticking by using climate and nature data and scenario analysis to surface strategic and actionable insights to shape investment decisions, operational priorities and long-term growth.

Climate risk is business risk – and there’s no one-size-fits-all answer

Global corporates face intensifying pressure from regulators, investors and customers to deliver on ambitious climate and sustainability commitments. While many businesses have earned recognition for leadership in disclosure and target-setting, the complexity of supply chains, exposure to physical climate risks, and rapidly shifting policy landscapes mean that achieving net zero demands more than ambition — it requires robust, science-based planning backed by financial insight.

What we do

What we do

Find out how the Risilience-powered platform, Riise, and advisory services can support corporate sustainability teams on their journey to net zero.

Risk identification

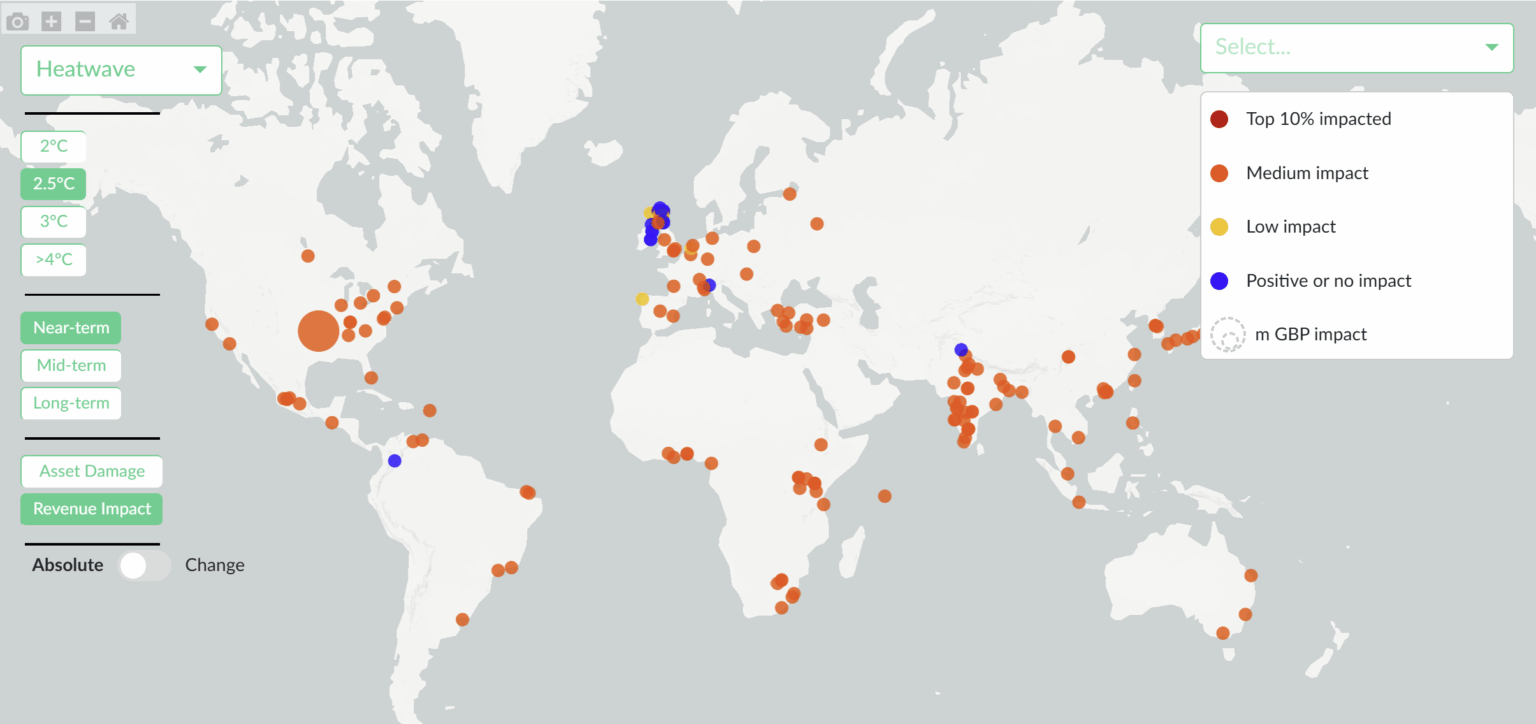

Identify material risks from physical climate impacts (flooding, heat stress, raw material availability) to transition challenges such as policy change, carbon pricing, and market shifts. Risilience can highlight risks based on the organisation’s global operations, upstream suppliers, packaging footprint, and highest value supply chain links.

Scenario analysis

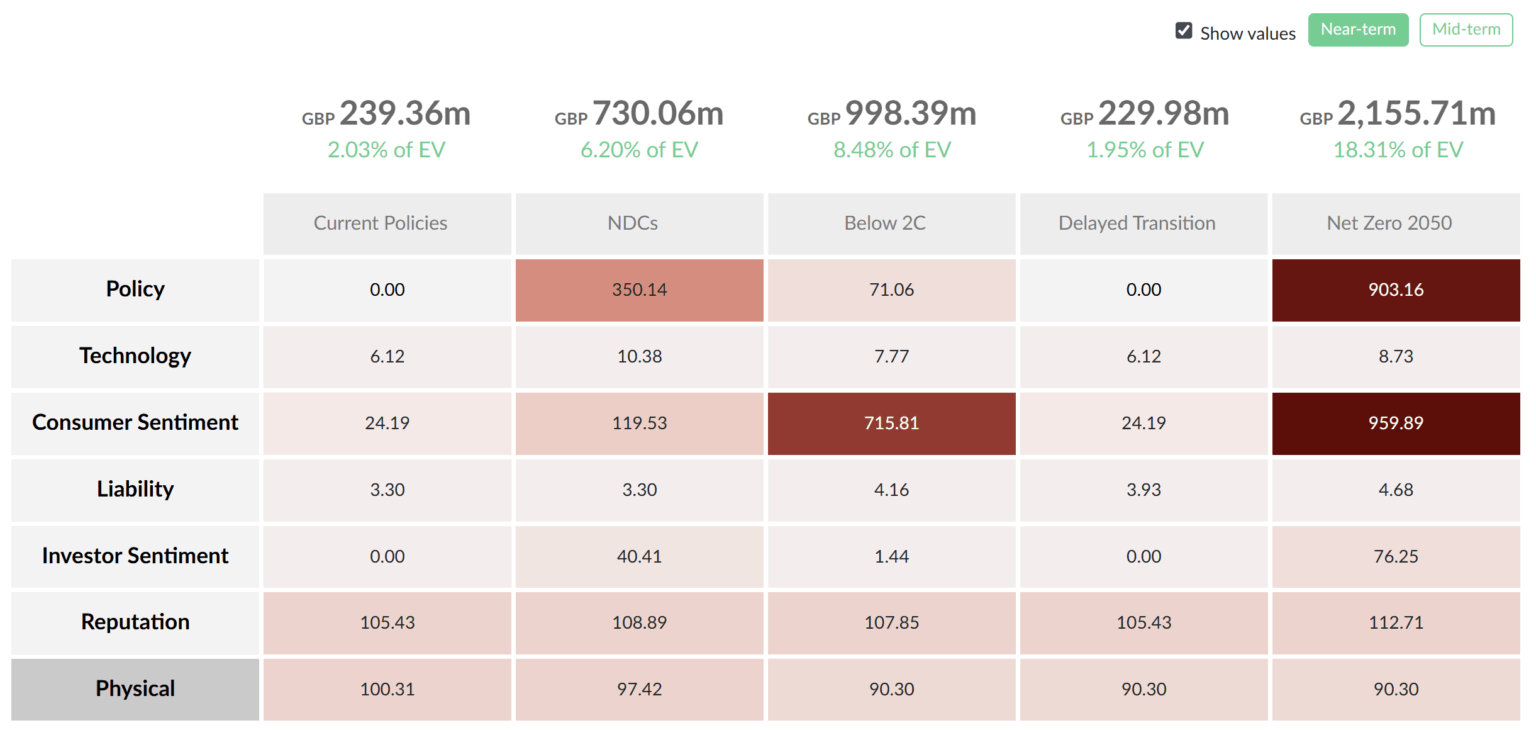

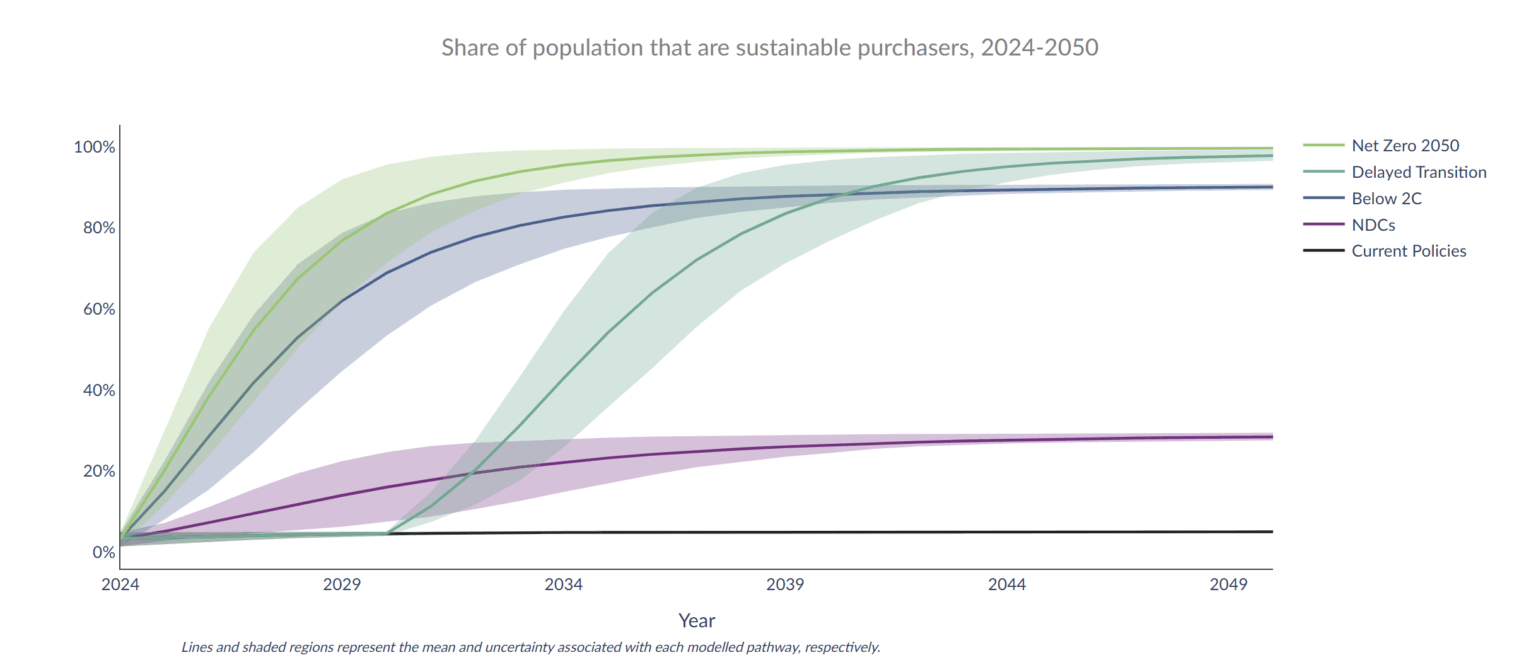

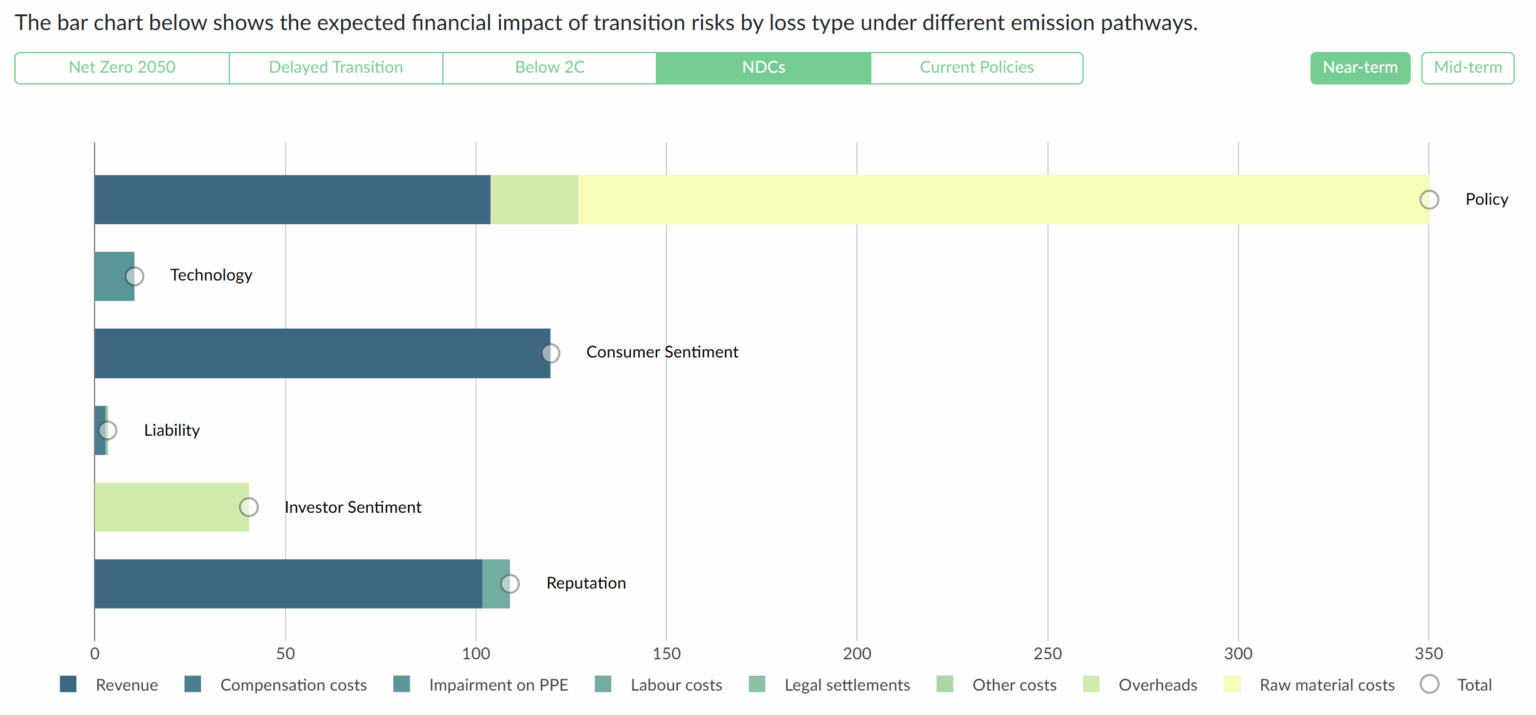

Model multiple futures using leading global scenarios (NGFS, IPCC, IEA, ISSB) to explore pathways under different warming trajectories and policy environments.

Financial impact quantification

Risilience translates climate uncertainty into actionable financial intelligence: effects on revenue, cost lines, capital investments, asset valuation, and cost of capital. Riise simulates a full range of financial and market variables across different climate pathways including interest rates, inflation, carbon pricing, and sectoral demand shifts.

Report on key metrics and targets

Model and track decarbonisation initiatives and quantify their impact on company Earnings Value at Risk. Align business strategy with evolving regulations (CA 261, CSRD) and voluntary frameworks (TCFD, SBTi, CDP) to report with confidence and credibility.

Let’s connect

Connect with our team to understand how Risilience can support your organisation to leverage compliance to create competitive advantage and deliver measurable business results.

Our offices

Let’s connect