Climate and Nature Risk Report 2025

Download reportThe Climate and Nature Risk Report 2025 reveals the latest insights on how the world’s largest businesses have responded to climate and nature risk in the wake of global geopolitical and economic uncertainty.

Independently conducted by Censuswide in August 2025, the report polls senior sustainability and finance executives across the US, UK and Europe on how global businesses with an annual turnover of $700m to $50 billion+ view climate and nature risk – and where it lands on the corporate business agenda.

“This report provides significant insights into the types of initiatives and processes that global companies are deploying to operationalise their sustainability strategies, and the challenges they face in their implementation.”

Dr Andrew Coburn, CEO Risilience

Risilience

Climate risk is business risk. Find out how the Risilience platform, Riise, delivers insights for global corporates to understand the financial implications of climate-and-nature-related risks and opportunities.

Risk identification

Risilience helps you identify the material climate-related financial risks your company faces. Our analysis covers both physical risks that could impact your operations and supply chain and transition risks as the world moves towards a lower-carbon economy. Our solution helps pinpoint relevant risks based on your operational footprint, industry sector, and value chain, aligning with the qualitative and quantitative disclosure requirements

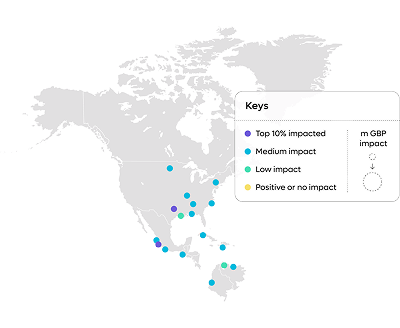

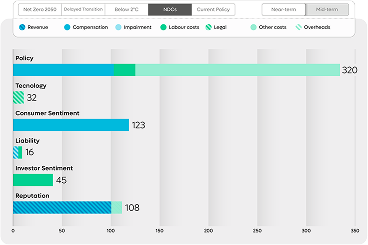

Summary financial impact of climate risk.

Financial impact quantification

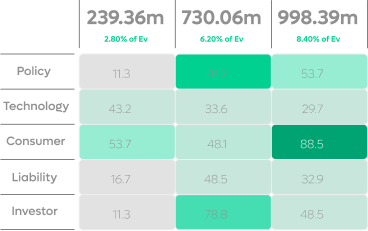

Risilience helps translate climate risks into tangible financial impacts. This step involves quantifying the potential financial implications of both physical and transition risks on your company’s revenue, costs, capital expenditures, asset valuations, and access to capital. Our analytics help you estimate these impacts, providing the data-driven insights needed to demonstrate the materiality of climate risks to investors and stakeholders, and to integrate these considerations into your broader financial planning.

Share of population that are sustainable purchasers, 2024-2025.

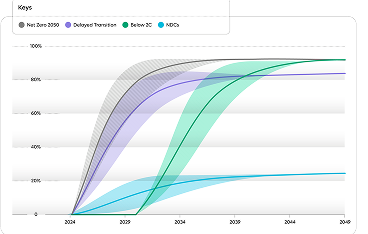

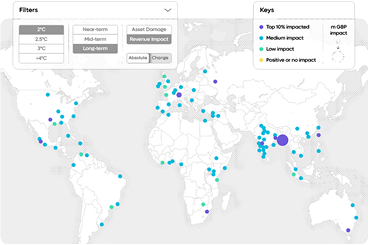

Scenario analysis

Regulators expect companies to use scenario analysis not just as a risk lens, but as a decision tool. This involves disclosing assumptions, uncertainties, and the financial effects of different warming pathways. Risilience can help you model the potential effects of these scenarios on your assets, liabilities and overall financial position, utilising scenarios derived from the Network for Greening the Financial System (NGFS). We supplement these scenarios with additional information on consumer trends and liability risks to provide a holistic understanding of potential business impacts, tying scenario analysis to financial flows and corporate strategy. Our tools provide the forward-looking insights necessary for robust disclosure.

EV@Risk by loss type per risk model.

Report on key metrics and targets

Risilience provides the relevant metrics used to assess climate-related risks and opportunities in line with your strategy and risk management processes. Our solution helps you identify meaningful targets and key metrics that can be used for reporting and tracking purposes, ensuring alignment with relevant metrics and disclosure recommendations.

Assess the financial impact of physical climate risks across multiple time horizons and emission pathways, ensuring alignment with global regulatory reporting frameworks.

Contact

Connect with Risilience

Learn how our award-winning platform, Riise, and expert team support global businesses to quantify the financial impact of climate-and-nature-related risks and opportunities.