Quantifying the financial impact of physical adaptation

Industry use case – retail

The industry challenge

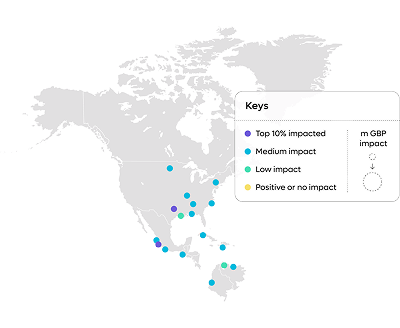

Many global retail businesses rely on the continued output from key sites located across countries that are increasingly exposed to climate-related risk of flooding. Disruption to operations can be costly and retailers are having to consider the potential financial impact of physical adaptation to mitigate disruption.

How we help

Using the Rislience-powered platform, Riise, a global retail organisation considered a range of ‘what if?’ scenario analysis to surface the financial impact of adaptation initiatives. The company quantified using mobile flood defences to protect their top 10 sites most exposed to flood risk.

These insights support the retailer to make strategic business decisions to prioritise the most cost-effective climate management initiatives.

Step-by-step solution

01.

Complete a baseline risk analysis to identify flood risk hotpots

02.

Select mitigation and adaptation strategies, e.g. 50cm mobile flood defences

03.

Apply Riise vulnerability and recoverability functions and run ‘what if’ analyses

04.

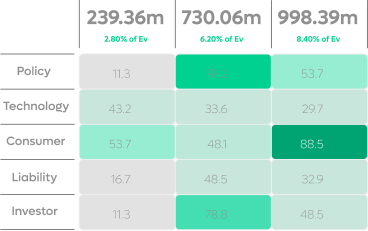

Compare cost of adapted risk analyses with the baseline function (site loses all capacity for 45 days/level 3 50cm flood)

Results

EarningsValue@Risk from flood hazard could be reduced by 8% over 10 years

Sustainability team was able to credibly engage with property and risk teams with valuable and actionable insights for ‘change management intervention’

Risilience

Climate and nature risk is business risk. Find out how the Risilience platform delivers insights for global corporates to understand the financial implications of climate-and-nature-related risks and opportunities.

Risk identification

Risilience helps you identify the material climate-related financial risks your company faces. Our analysis covers both physical risks that could impact your operations and supply chain and transition risks as the world moves towards a lower-carbon economy. Our solution helps pinpoint relevant risks based on your operational footprint, industry sector, and value chain, aligning with the qualitative and quantitative disclosure requirements

Summary financial impact of climate risk.

Contact Us

Connect with Risilience

Learn how our award-winning platform, Riise, and expert team support global businesses to quantify the financial impact of climate-and-nature-related risks and opportunities.