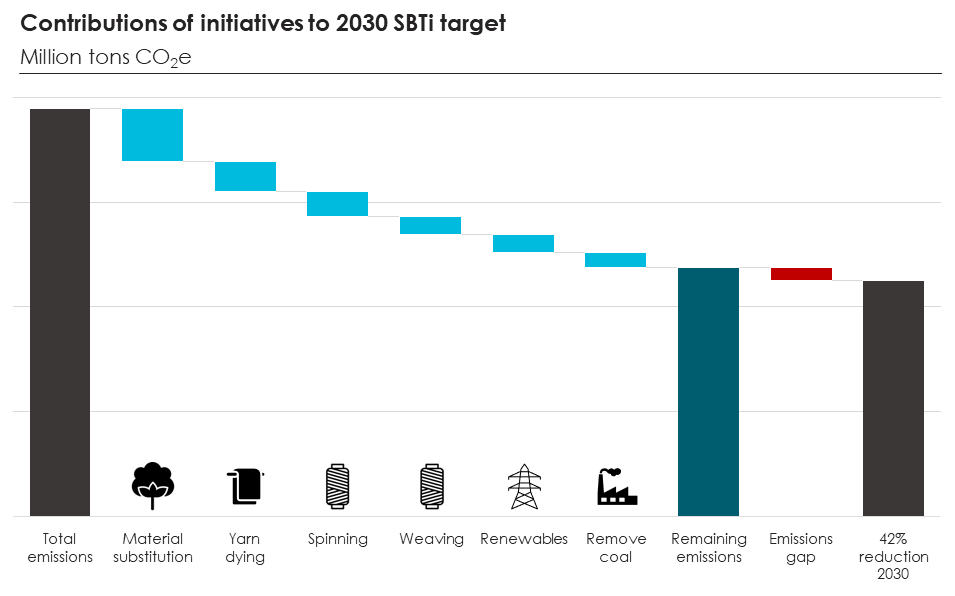

Identifying decarbonisation initiatives to meet company targets

Industry use case – fashion and apparel

The industry challenge

Many global apparel brands with Scope 3 upstream concentration and limited supply-chain transparency need support to meet net-zero goals. Identifying and modelling potential emissions reduction initiatives provides sustainability leaders with the insights to decide which initiatives to prioritise.

How we help

Using the Rislience-powered platform, Riise, a leading apparel brand was able to model a number of initiatives and quantify the decarbonisation contributions per initiative, across multiple emissions pathways.

These insights enable the apparel company to present data-driven decarbonisation plans to the Board and advance initiatives with the best ROI.

Step-by-step solution

01.

Research and build initiatives: (i) Prioritise emissions associated with large volume and GHG-intensive materials, (ii) Prioritise key suppliers with impactful GHG reduction levers: fossil fuel-based energy and renewables access, (iii) Material substitution, yarn dying, spinning, weaving, renewables and coal removal.

02.

Use Riise to model decarbonisation contributions per initiative, across multiple emissions pathways.

03.

Generate Marginal Abatement Cost (MAC) per initiative.

04.

Present methodology and results to internal stakeholders.

Results

Top five initiatives deliver 39% emissions reduction by 2030.

Material substitution(sustainably sourced cotton) delivered the greatest GHG reduction with minimal green premium

Results used to influence supplier engagement strategy

Plan presented to the board.

Risilience

Climate and nature risk is business risk. Find out how the Risilience platform delivers insights for global corporates to understand the financial implications of climate-and-nature-related risks and opportunities.

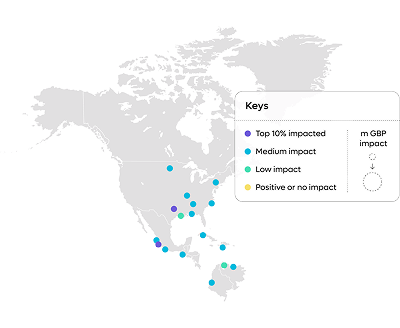

Risk identification

Risilience helps you identify the material climate-related financial risks your company faces. Our analysis covers both physical risks that could impact your operations and supply chain and transition risks as the world moves towards a lower-carbon economy. Our solution helps pinpoint relevant risks based on your operational footprint, industry sector, and value chain, aligning with the qualitative and quantitative disclosure requirements

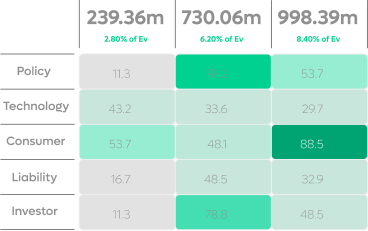

Summary financial impact of climate risk.

Contact Us

Connect with Risilience

Learn how our award-winning platform, Riise, and expert team support global businesses to quantify the financial impact of climate-and-nature-related risks and opportunities.