Managing climate-driven financial impact on ingredients supply and facility damage

Industry use case – food and beverage

The industry challenge

Assessing the financial impact of climate change on global operations is a key concern for global food and beverage brands. Climate-related weather events impact ingredients supply and can lead to damages and disruption to facilities. Identifying the most pressing financial risk to business is critical to strategic planning.

How we help

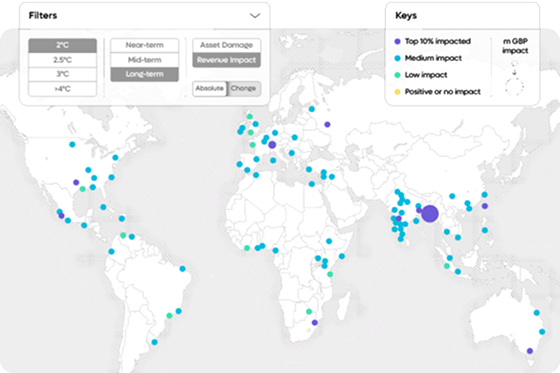

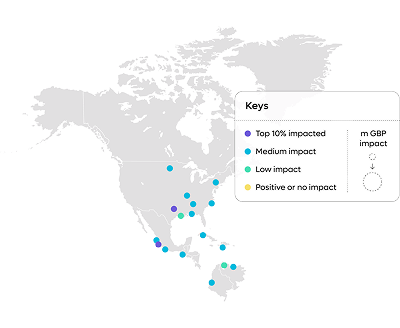

Working with a global food and beverage brand, the Risilience-powered platform, Riise, delivers climate analytics to surface business-first insights, including an aggregated and comparative understanding of the financial exposure for centralised, regional and local stakeholders. These insights support the company to make and prioritise strategic decisions to mitigate yield impacts and damage to value chain facilities.

Step-by-step solution

01.

Create virtual physical footprint by building a Riise digital twin, capturing locations of key facilities and ingredient sourcing volumes by country.

02.

Improve resolution of ingredients’ growing locations and hazard exposure using Riise global and local production layer data.

03.

Apply climate change models (CMIP6) to assess the impact of climate hazards on crops and value chain facilities.

04.

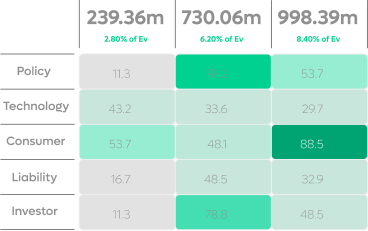

Convert damage and disruption and yield impacts into unifying metrics, including revenue/costs shocks and EarningsValue@Risk

Results

Ingredient sourcing is identified as the largest threat; facility damage and disruption less than expected

Exposed ingredient sourcing to be diversified and/or protected

Insights aid business case to reduce exposure for operational ‘pinch-points’.

Risilience

Climate and nature risk is business risk. Find out how the Risilience platform delivers insights for global corporates to understand the financial implications of climate-and-nature-related risks and opportunities.

Risk identification

Risilience helps you identify the material climate-related financial risks your company faces. Our analysis covers both physical risks that could impact your operations and supply chain and transition risks as the world moves towards a lower-carbon economy. Our solution helps pinpoint relevant risks based on your operational footprint, industry sector, and value chain, aligning with the qualitative and quantitative disclosure requirements

Summary financial impact of climate risk.

Contact Us

Connect with Risilience

Learn how our award-winning platform, Riise, and expert team support global businesses to quantify the financial impact of climate-and-nature-related risks and opportunities.