January 2026: New Risilience analysis shows climate-related transition risks are the most immediate threat facing global organisations.

January 2026: Despite the slowdown of policymakers tackling greenhouse gas emissions, new Risilience data reveals that global businesses still face financially material transition risks in the next five years.

“The transition to a low-carbon economy represents one of the most disruptive changes businesses have faced in decades. Slower national decarbonisation efforts by policymakers have not made a material difference to the challenges faced by multinational companies”

Dr Andrew Coburn, CEO Risilience

During the past year, various governments around the world have deprioritised efforts to decarbonise energy and economic systems by extending target deadlines and reducing investments and incentives. This has extended the world’s “decarbonisation pathway” and made a warmer world more likely.

Multinational corporations might conclude from this that their transition risks have reduced, assuming carbon taxes will rise less steeply, and regulations will be postponed. However, despite the slowing pace of policy, transition risks remain material. In the longer term, a slower reduction of global emissions means that the physical risks impacting corporations will be exacerbated.

In fact, companies will face costly adaptation to a more hazardous and volatile physical risk environment. Furthermore, as the impacts of climate change intensify and society accelerates efforts to mitigate further damages, the necessary pace of emissions reduction will create a more severe and disruptive transition risk landscape.

Unique Risilience analysis shows climate-related transition risks are the most immediate threat facing global organisations, in the next five years, outpacing both physical and nature-related risks.

Transition risks at the forefront

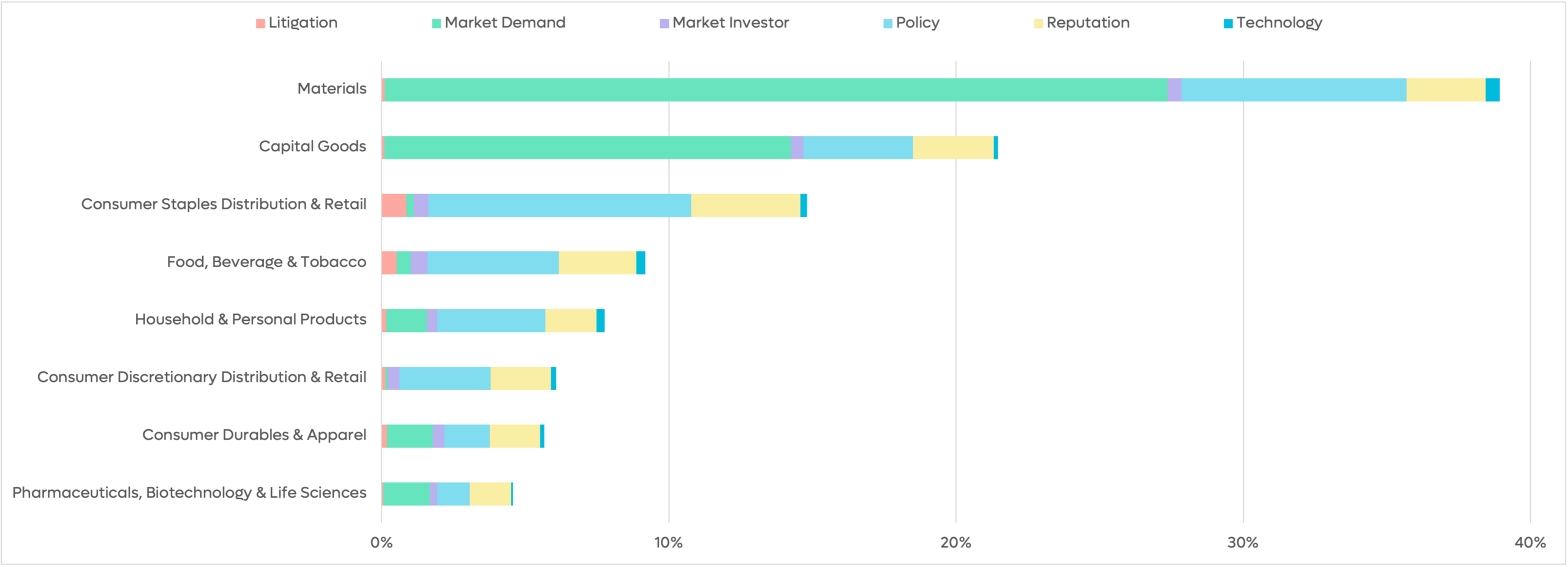

Table 1: Greatest transition risk in the next five years by sector. Analysis of global companies in a NDCs scenario. (Risilience analysis of Risilience transition risk models and 2025 EVTR dataset)

| Industry | Greatest risk | % of five-year earnings at risk |

| Materials | Market Demand | 27% |

| Capital Goods | Market Demand | 14% |

| Consumer Staples Distribution & Retail | Policy | 9% |

| Food, Beverage & Tobacco | Policy | 5% |

| Household & Personal Products | Policy | 4% |

| Consumer Discretionary Distribution & Retail | Policy | 3% |

| Consumer Durables & Apparel | Reputation | 2% |

| Pharmaceuticals, Biotechnology & Life Sciences | Market Demand | 2% |

Climate transition risks are the financial, operational, and strategic shocks organisations face as the world shifts to a low-carbon economy – driven by policy changes, new technologies, market shifts, and evolving stakeholder expectations. Analysis of the Risilience transition risk models and 2025 Earnings Value at Transition Risk (EVTR) dataset reveals the most pressing climate-related transition risks for specific sectors in the next five years (see Table 1 above).

For industrial sectors including Materials (including mining, chemicals, construction materials and forestry and packaging products) and Capital Goods, market demand shifts represent the most significant risks. The economic disruption caused by a low-carbon transition will have the most significant impact on energy-intensive firms, causing systemic shifts in the type of goods in demand and growing demand for greener, low-carbon materials.

However, these demand shifts also create significant opportunities for firms who can adapt to new market dynamics, and this will create an economic landscape of winners and losers.

For many consumer goods sectors, policy risk poses the most material financial risk, as their large supply chain (Scope 3) emissions footprints increasingly fall within the scope of expanding carbon price regulations. This is despite the tumultuous economic, geopolitical and climate-related headwinds witnessed in 2025 which challenged the speed and scope of global decarbonisation.

Figure 1: Top sector-specific climate transition risks in next five years. Analysis of global companies in a NDCs scenario. (Risilience analysis of Risilience transition risk models and 2025 EVTR dataset)

Accelerating energy transition

Despite the rollback of some climate ambitions in certain jurisdictions, the real economy is expected to continue its exponential transition towards a low-carbon future, driven by a combination of regulatory pressures, market forces, and technological advancements.

Significantly, in 2026, renewables will overtake coal to become the world’s top power source and drive over 90% of new global power capacity additions, largely driven by a solar boom in China. For businesses, this translates into an opportunity for cost management – renewables are now the most cost-effective source of new energy. This reality, plus an insatiable electricity thirst to power AI growth, is fuelling a surge in renewable purchase power agreements (PPAs). In 2026, as grids cope with variable renewable generation, when energy is consumed matters, and companies that adapt energy demand can turn energy management from a cost item into an opportunity to enhance profitability.

A fragmented and evolving policy landscape

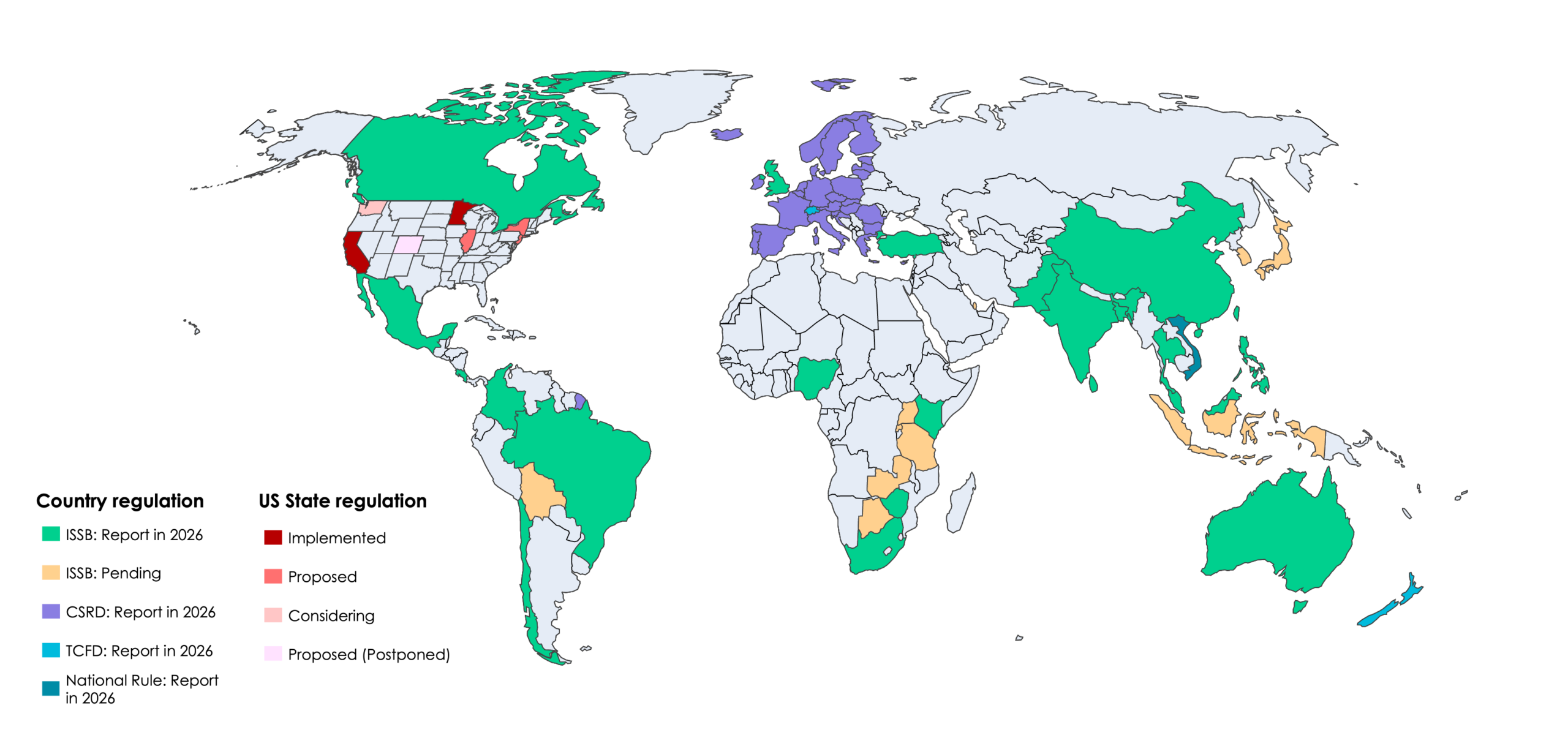

In 2026, climate policy will continue to grow more disparate across global jurisdictions, requiring a nuanced and location-specific approach to risk management.

Where a business operates is a crucial determinant of its exposure to policy risks. Regions with strong climate leadership will continue to drive greater costs of compliance and financial risks for businesses operating within their jurisdictions.

Figure 2: Global sustainability-related reporting requirements by jurisdiction

Regulatory ambition is also shifting geography: in 2026, China, Hong Kong, Singapore and Japan will introduce ISSB-aligned mandatory reporting. As major manufacturing and technology hubs which account for a rising share of global economic output and capital, these rules will surface sustainability data for the supply chains of globalised organisations.

Continued momentum on carbon pricing is increasing the coverage of global emissions with carbon prices – countries including India, Brazil, Turkey, Malaysia and Vietnam are introducing carbon taxes or market-based schemes this year. Coverage of global emissions is expected to increase from 28% in 2025 to 33% by the end of 2026, bringing firms’ supply chain emissions in major markets into scope of carbon policies

However, while coverage is increasing, carbon prices will rise at a pace slower than anticipated. The global-weighted average carbon price has slowly risen to $6 per tonne today – far below the $25 per tonne price that Risilience projects is required to meet country Nationally Determined Contribution (NDC) commitments. Nevertheless, carbon markets have proven effective in regulating emissions and incentivising decarbonisation. As of January 2026, the EU’s Carbon Border Adjustment Mechanism (CBAM) moves from an initial reporting-only phase to its financially binding “definitive” period. The CBAM is designed to curb carbon leakage by imposing a carbon cost on imports of carbon-intensive goods equivalent to that faced by EU producers under the Emissions Trading System (ETS). Importers are now required to purchase and surrender certificates to cover their emissions – effectively putting a carbon price on imports.

Physical risks on the horizon

Transition risk dominates the business landscape, but physical risk remains material. While Risilience analysis finds that transition risks are typically greater in magnitude than expected (i.e. probability-weighted) physical risks, such as extreme weather events, have the potential to cause catastrophic losses. These tail risks are highly uncertain and are increasing over time with the progression of climate change.

With every incremental increase in global temperatures, the risk of widespread climatic events causing systemic value chain disruption grows.

The imperative to prepare for the inevitable

Physical risks are already baked into our future and inevitable in the medium-to-long term. This makes 2026 a critical window of opportunity for businesses to invest in understanding, quantifying, and adapting to these longer-term physical risks.

Making “no-regret” decisions now will be crucial for building resilience and ensuring long-term business continuity.

As Andrew Coburn, CEO of Risilience, states: “Despite the challenging business environment, multinational corporations across sectors are prioritising sustainability initiatives as a business strategy. Sustainability is increasingly seen as a strategic objective, not simply as compliance or a benevolent contribution. Organisations are recognising the commercial opportunities that are represented by embracing sustainability and are shaping up to increase their investments in net-zero initiatives as a profitable business strategy.”

The year ahead will be pivotal for many global corporations as established business models are challenged, requiring a rethinking of product design, a reconfiguration of supply chains, and changes in technology, distribution, real estate, and almost every aspect of operations and infrastructure.

Savvy business leaders will view the economic transition less as a compliance burden and more as a powerful disruptive force creating new winners and losers. The opportunities extend far beyond energy bills, unlocking value for those who rethink operations, materials, and logistics for future profitability.

• For more sector-specific insights and solutions see Risilience.com

• To learn more about how Risilience can support organisations to optimise business opportunity from sustainability, get in touch.