Material matters: facing up to a net-zero and nature-positive future

In the transition to the net-zero and nature-positive future, the fashion sector finds itself the subject of increasing scrutiny. How does a global fast fashion brand navigate regulation and changing consumer demand to become profitably sustainable? Dr Paul Burgess, Client Development Europe, and Saim Ghouse, VP US Sales, shine a light on Wardrobe Inc., a fictional global fashion brand that pressed reset to succeed.

Fast-forward the fashion industry ten years from now. It’s 2034 and Wardrobe Inc., a global fashion brand, is on track to meet its climate and nature targets and becoming an exemplary presence in the sector, shaping the future of fashion. Despite challenges along the way, Wardrobe Inc. has cut its cloth to transition from a fast-fashion company to a brand synonymous with sustainability and innovation. So, how did Wardrobe Inc. do it?

Sector-specific challenges

Our recent report Market trends: sustainability as business opportunity in fashion and apparel, features a case study following the fictional fashion company Wardrobe Inc. that represents the sector-specific challenges and opportunities faced by many global fashion brands today.

These include meeting increasingly demanding regulatory and stakeholder requirements around disclosure of environmental dependencies, risks and opportunities, developing a robust transition plan, and connecting multiple internal teams, from sustainability, to risk, finance, product design and sourcing, and operations, to ensure change is implemented business wide.

Business model at odds with changing market demand

Wardrobe Inc. has much in common with many global fashion brands today. Driven by rapid production cycles and cost efficiencies, the company’s 2024 business model is increasingly at odds with evolving market demands and a rising global consciousness around environmental and ethical practices. The organisation’s leadership know the risks of continuing with business-as-usual; regulation, consumer demand, climate-related litigation and investor pressure are driving the sector to become more sustainable and the consequences of not meeting expectations threaten Wardrobe Inc.’s brand reputation and bottom line.

Transitioning the business to thrive in the net-positive economy, Wardrobe Inc. must build a credible and actionable plan that balances risks and opportunities across the areas it can control, such as Scope 1 and 2 greenhouse gas emissions (GHG), with external factors beyond the brand’s direct control, including Scope 3, wider grid decarbonisation and changing market demand. In addition, Wardrobe Inc. needs to prepare for the expanded scope of sustainability reporting and management, performing early double-materiality assessment that connects seemingly disparate threads, including water, soil, biodiversity and carbon.

Financial quantification of risks and opportunities

A complex task at corporate level, assessing these various contributing factors requires climate scenario analysis that can consider a range of transition pathways and financially quantify the associated risks and opportunities. Using advanced analytics, Wardrobe Inc. is able to consider the losses caused by the global transition to a low-carbon economy, expressed as earnings-value-at-risk (EV@Risk), and identify products with the highest transition risks to the business.

Data are key to understanding the entire value chain of an organisation and the associated climate-and-nature footprint. This holistic view of Wardrobe Inc. enabled leadership to prioritise actions that reduced emissions, such as opting for renewable energy sources and redesigning logistics; initiatives that significantly enhanced energy and water efficiency across the company’s operations, and throughout its supply chain.

Making material choice a strategic decision

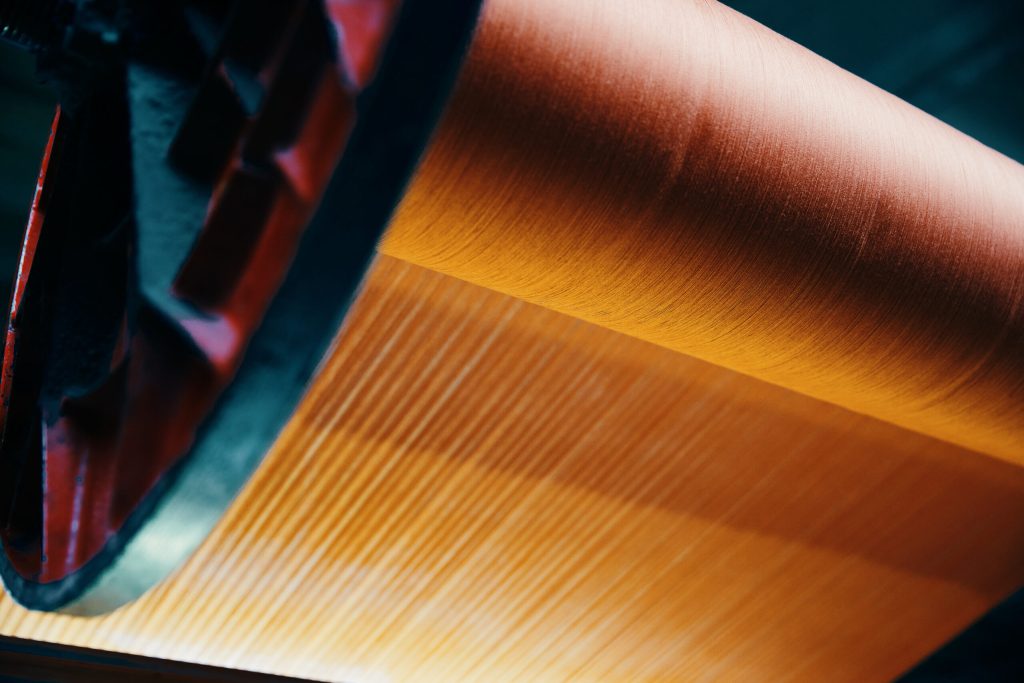

Understanding and managing the mix of textiles within its range became a priority for Wardrobe Inc. and leveraging supply-chain insights was critical to the launch of a new collection, Nature’s Wardrobe, that centred on integrating eco-friendly materials into its products, marking a pivotal commitment to sustainability as a core strategic direction.

Decision-making was informed by a comprehensive assessment of different raw-material feedstocks that surfaced the challenges underlying decision-making between balancing emissions, land-use, water consumption and pollution, as well as garment longevity and recyclability.

The assessment also revealed how yield changes in cotton could impact sourcing, cost and design decisions and how choices impacted EV@Risk. The results of the assessment enabled the company to diversify its raw-material sources, moving away from standard cotton, known for its high emissions and poor environmental impact, towards more sustainable options, such as recycled cotton, organic cotton, bamboo and hemp. This shift in raw-material strategy also helped reduce the company’s vulnerability to physical climate risks, as extreme weather events were beginning to negatively impact cotton yields.

By shifting away from environmentally harmful products, data analytics showed that climate-related risks decreased from 8.7 per cent of annual revenue to just 1.6 per cent of annual revenue in 2030. Wardrobe Inc. was also able to determine the potential for market demand shifts under different climate scenarios using the market demand projections for the different climate pathways.

Pressing reset to become profitably sustainable

Taking a proactive approach to driving change supported by data and advanced analytics positioned Wardrobe Inc. as a key player in international forums, advocating for sustainable practices and pushing other companies to adopt greener strategies. The company is investing heavily in the research and development of next-generation eco-friendly materials, highlighting strong market demand for natural, zero-carbon and nature-positive fibres, while exploring new business models that prioritise durability and reparability of garments.

Despite facing initial hurdles, such as increased costs and complex supply-chain adjustments, this move was critical in positioning Wardrobe Inc. as a leader in sustainable fashion, helping to mitigate broader business risks and demonstrating that sustainability can be synonymous with profitability.

- Read the Wardrobe Inc. case study in the discussion paper Market trends:sustainability as business opportunity in fashion and apparel.

- For more information on how Risilience can help you on your sustainability journey: contact@risilience.com