Quantifying climate and nature risk: food and beverage

Transitioning towards the low-carbon economy is presenting food and beverage companies with unprecedented market challenges. The Risilience-powered platform, Riise, and team of specialists support global food and drink companies to quantify, plan, and act on the financial impacts of climate and nature risks for commercial success.

Climate and nature risk is business risk

The transition to a low-carbon economy represents one of the most disruptive changes food and beverage organisations have faced in decades. It challenges established business models and requires rethinking product design, reconfiguring supply chains, changing technology, distribution, real estate and almost every aspect of operations and infrastructure.

How Risilience supports food and beverage

riise solution

Reporting and disclosure

Riise supports organisations to meet their global sustainability reporting obligations covering physical and transition risks across climate and nature with accuracy, consistency, traceability and credibility.

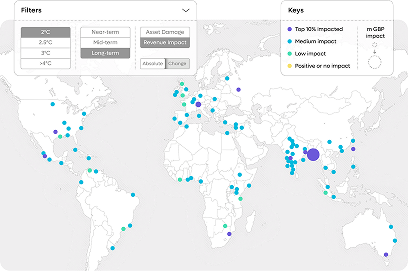

With a commercially focused approach, Riise enables the assessment of financial materiality across short-, medium- and long-term horizons under multiple emissions scenarios. Our outputs are aligned with global reporting frameworks including TCFD, CSRD, SB 261 and TNFD, among others, ensuring regulatory readiness and strategic foresight.

Riise quantifies the financial impact of both transition and physical climate and nature risks, supporting commercially relevant insights for use across the business from executive leadership to individual business units, product categories, facilities, EHS, risk, finance, sustainability and procurement.

Riise delivers improved strategic planning, greater business resilience, aligned financial and sustainability outcomes, and informed, data-driven decision making.

riise solution

Strategic decision support

Risilience operationalises environmental intelligence across the business, driving future-focused decisions that strengthen long-term resilience to environmental risks.

Riise helps businesses prepare for and take advantage of the economic growth of the transition to the low-carbon economy. Sustainable businesses are more resilient to shocks from future carbon taxes, have better talent motivation and retention, and can avoid the downside shocks of technology change, stranded assets, liability and litigation penalties, and reputation damage.

riise solution

Transition planning and insights

Riise supports the creation of a credible and actionable transition plan, bringing together risk insights, financial quantification and fully costed initiatives into a single optimised view.

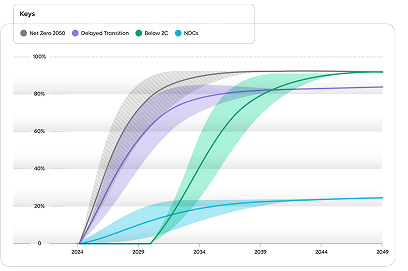

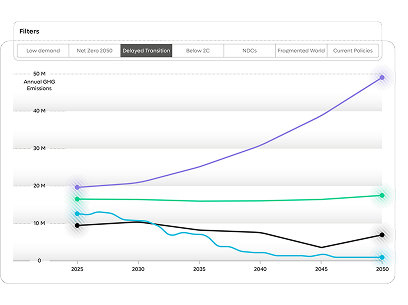

Forecast emissions change out to 2050 based on an organisation’s growth, wider economic decarbonisation trends and company-specific transition plans.

Riise enables businesses to stress test emission reduction forecasts considering different emission pathways and view the material impact of initiatives that drive net-zero goals.

Financially quantified information is captured to support the cost-benefit analysis of individual transition initiatives, employing Marginal Abatement Cost Curves to quantify reduction initiatives by maximum potential, technical feasibility and economic viability.

GHG emissions trajectories until 2050

Meet the Risilience team

The place |

The time |

|

|---|---|---|

28-29 January, London |

||

Future of Food by Economist Impact |

10 February 2026, London |

|

17-19 February 2026, Phoenix, AZ. |

||

1-3 March 2026, Denver, CO |

||

25-26 March 2026, London, UK |

||

Read our food and beverage whitepaper

Speak with a member of our team

Get in touch with the Risilience team to learn how we support food and beverage companies to optimise business opportunities from sustainability.

January 2026: New Risilience analysis shows climate-related transition risks are the most immediate threat facing global organisations.

Let’s connect

Find out more – talk to our advisors or book a

demo with Risilience