The California Climate Acts: what you need to know

Are you prepared for the new California Climate Acts? Download our paper, The California Climate Acts – what you need to know, to find out what’s involved and how you can keep ahead in the fast-moving global-policy landscape.

How we help

How we help

Find out how Risilience can prepare your business for the new California Climate Acts.

Risk identification

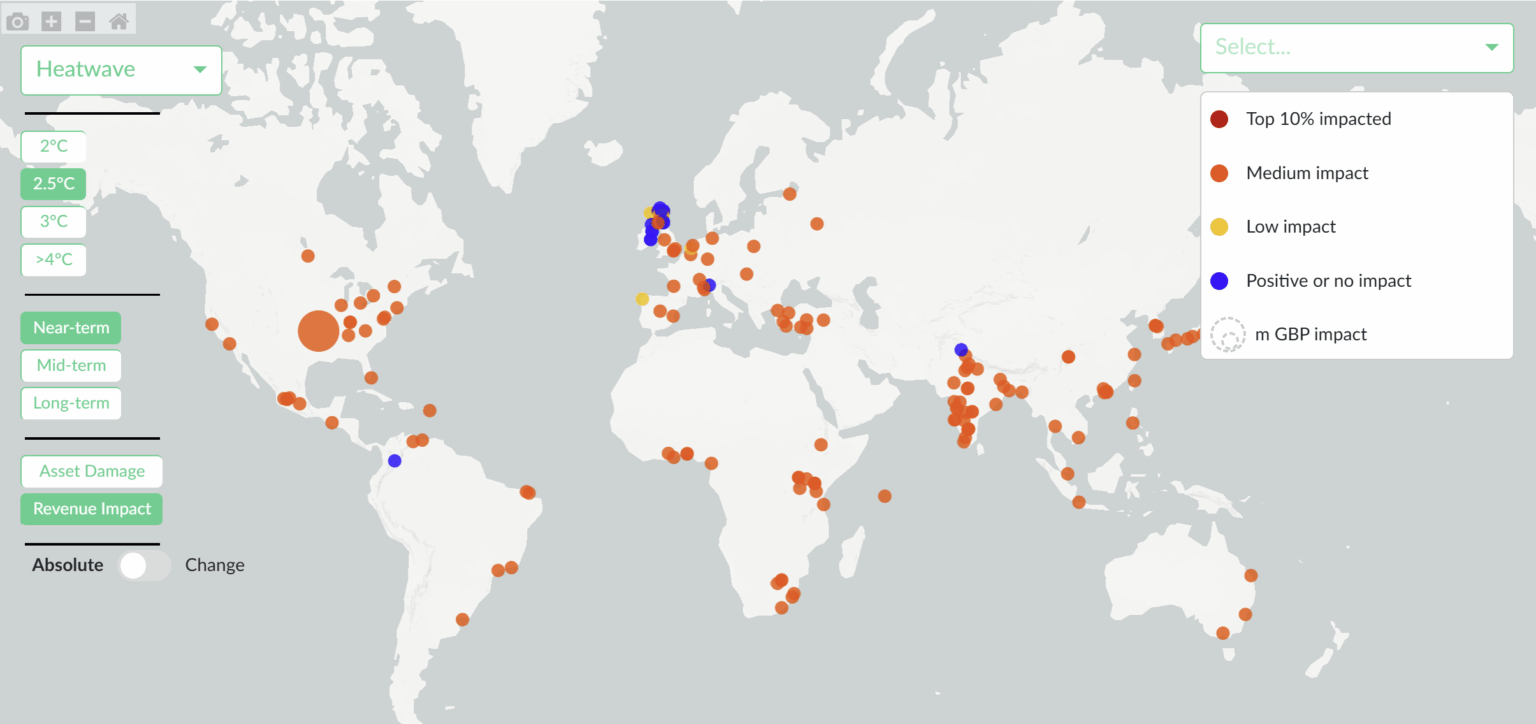

Risilience helps you identify the material climate-related financial risks your company faces. Our analysis covers both physical risks that could impact your operations and supply chain and transition risks as the world moves towards a lower-carbon economy. Our solution helps pinpoint relevant risks based on your operational footprint, industry sector, and value chain, aligning with the qualitative and quantitative disclosure requirements of SB 261 and other regulatory frameworks including ISSB and CSRD.

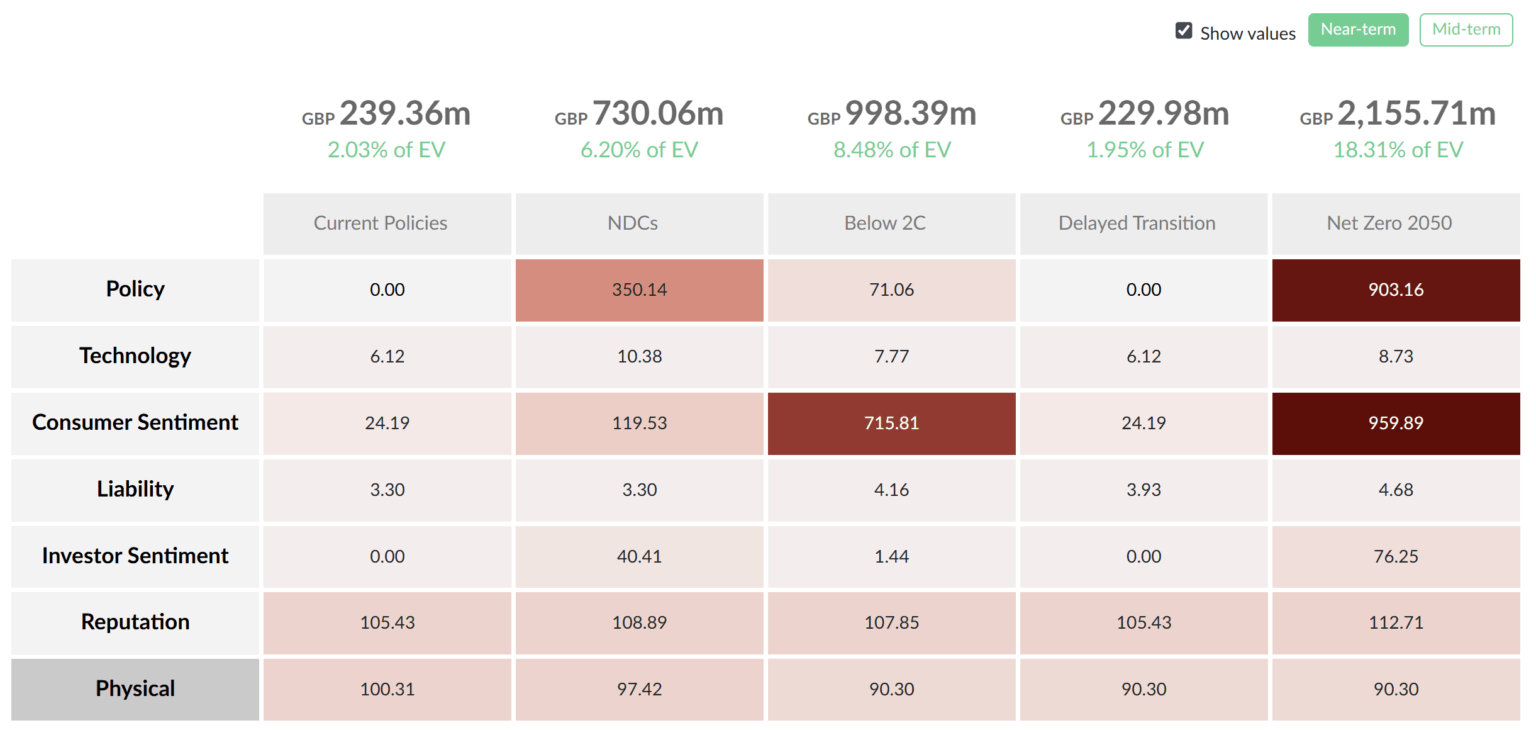

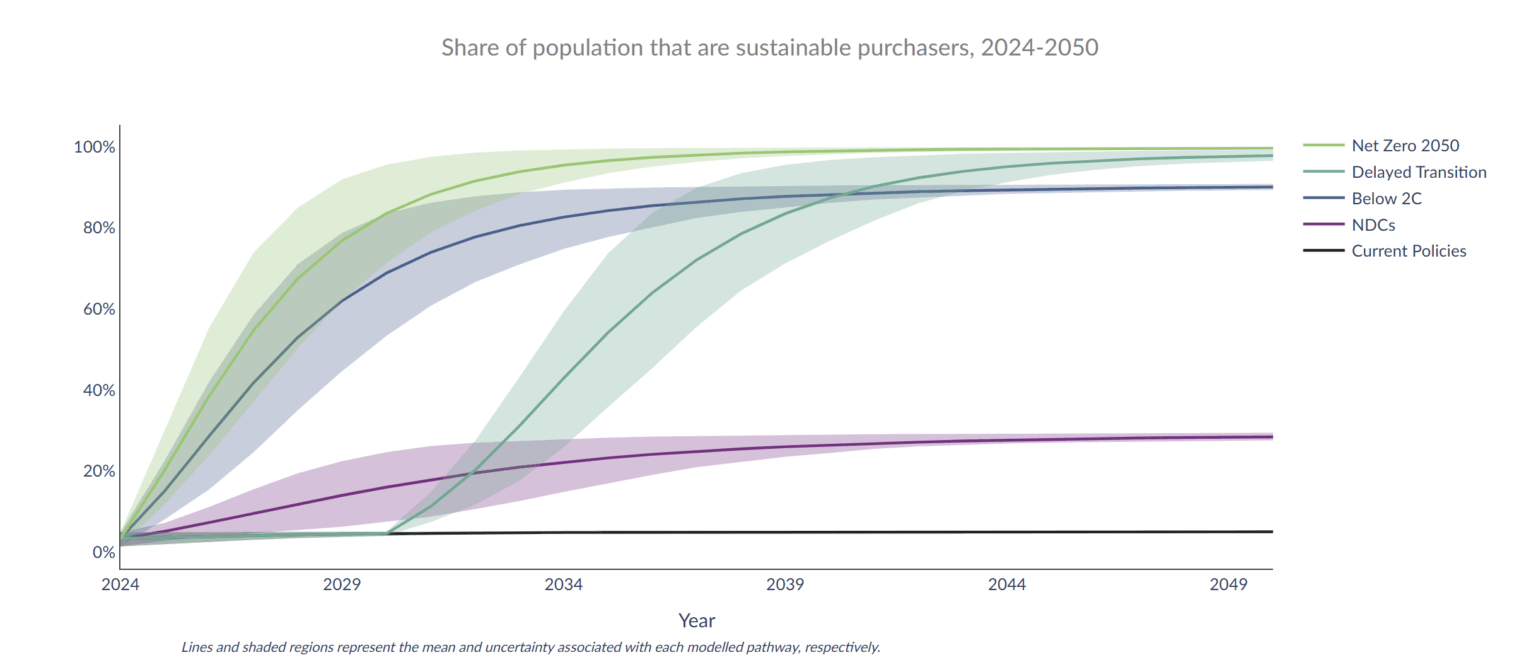

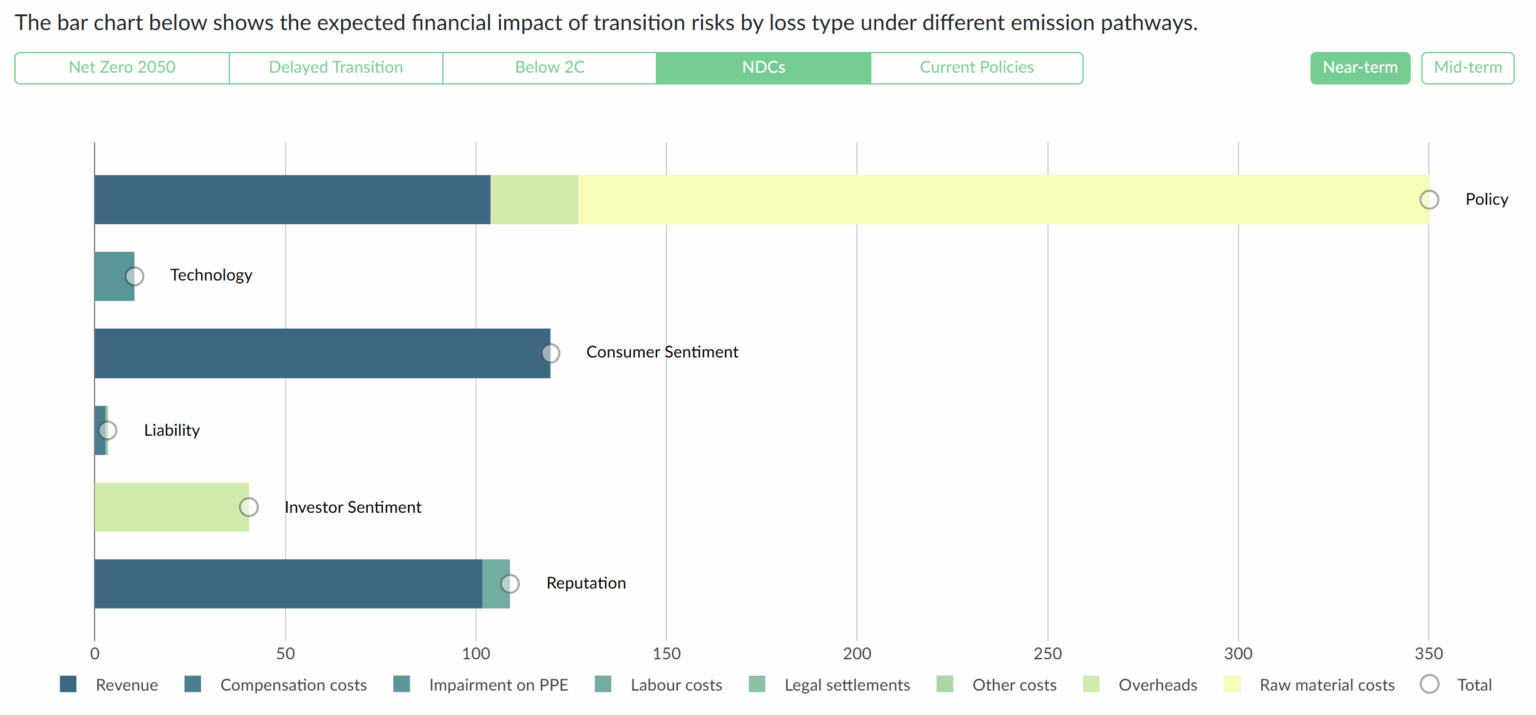

Scenario analysis

To assess the potential impact of identified risks, SB 261 requires companies to conduct climate-related scenario analysis to understand how different climate futures could impact your business strategy, operations and financial performance over short, medium and long-term horizons. Risilience can help you model the potential effects of these scenarios on your assets, liabilities and overall financial position, utilizing scenarios derived from the Network for Greening the Financial System (NGFS). We supplement these scenarios with additional information on consumer trends and liability risks to provide a holistic understanding of potential business impacts. Our tools provide the forward-looking insights necessary for robust disclosure.

Financial impact quantification

Risilience helps translate climate risks into tangible financial impacts. This step involves quantifying the potential financial implications of both physical and transition risks on your company’s revenue, costs, capital expenditures, asset valuations, and access to capital. Our analytics help you estimate these impacts, providing the data-driven insights needed to demonstrate the materiality of climate risks to investors and stakeholders, and to integrate these considerations into your broader financial planning.

Report on key metrics and targets

Risilience provides the relevant metrics used to assess climate-related risks and opportunities in line with your strategy and risk management processes. While SB 261 primarily focuses on financial risk, it implicitly encourages the disclosure of strategies to mitigate and adapt to these risks, which may involve reporting on relevant internal or external targets to demonstrate progress and commitment. Our solution helps you identify meaningful targets and key metrics that can be used for reporting and tracking purposes, ensuring alignment with SB 261 and TCFD disclosure recommendations.

Speak with a member of our team

Book a session with a member of our team to understand how Risilience can empower your organisation in anticipation of the CCA.

California Climate Acts – FAQs

Covered entities must prepare and publish their first report by January 1, 2026.

Both public and private companies with annual revenues exceeding $500m doing business in California

In-scope companies are required to assess and disclose both physical risks (e.g., climate-related damage to assets) and transition risks (e.g., policy, legal, and market changes associated with moving to a low-carbon economy), as well as the measures adopted to reduce and adapt to these risks.

The CCA mandates multi-horizon scenario analysis, which includes: Near-term (up to 5 years) Medium-term (up to 10 years) Long-term (2050 and beyond) These must be aligned with Task Force on Climate-Related Financial Disclosures (TCFD) frameworks or an equivalent standard such as the IFRS Sustainability Disclosure Standards.

Virtual conversation: ‘From policy lag to market shock: why businesses can’t ignore climate transition risk in 2026’

Our offices

Let’s connect