Australian Sustainability Reporting Standards: what you need to know

In 2024, Australia passed landmark legislation embedding climate disclosures into the very core of corporate accountability, and the direction of travel is global. Read our resources and learn how Risilience can help you keep ahead in the fast-moving global-policy landscape – and leverage disclosures as strategic opportunity, not regulatory burden.

How we help

How we help

Find out how Risilience can help you keep ahead in the fast-moving global-policy landscape.

Risk identification

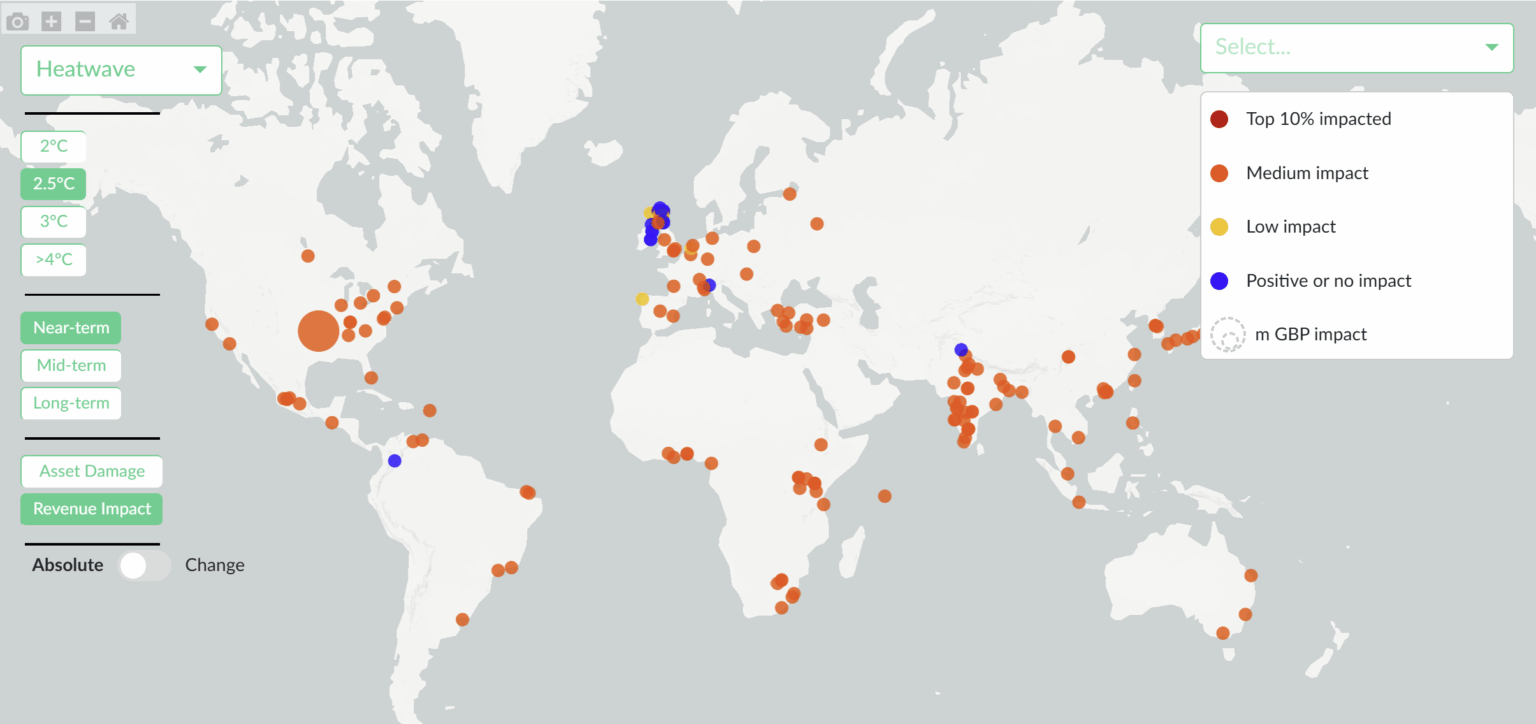

Risilience helps you identify the material climate-related financial risks your company faces. Our analysis covers both physical risks that could impact your operations and supply chain and transition risks as the world moves towards a lower-carbon economy. Our solution helps pinpoint relevant risks based on your operational footprint, industry sector, and value chain, aligning with the qualitative and quantitative disclosure requirements of the ASRS and other regulatory frameworks including SB 261, CSRD and TCFD.

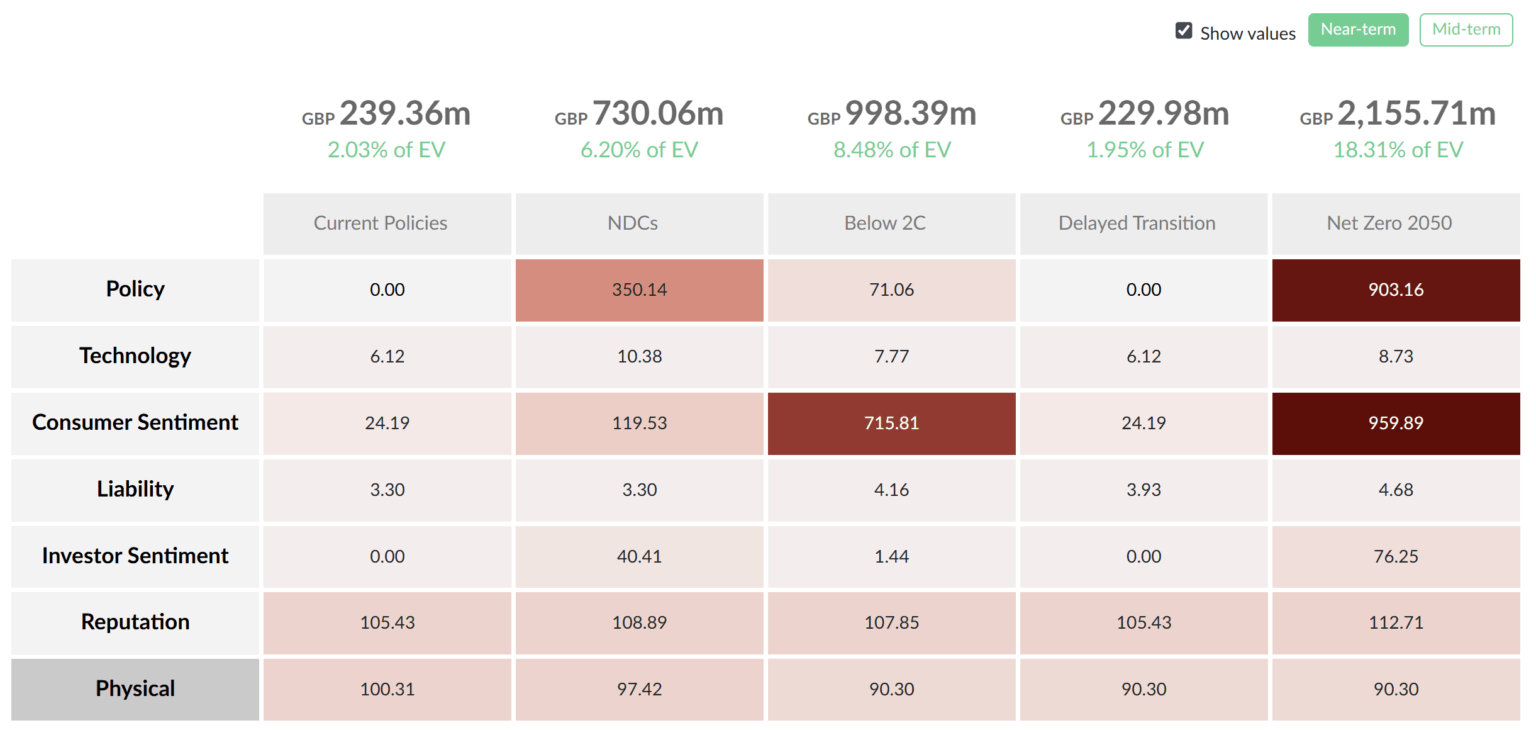

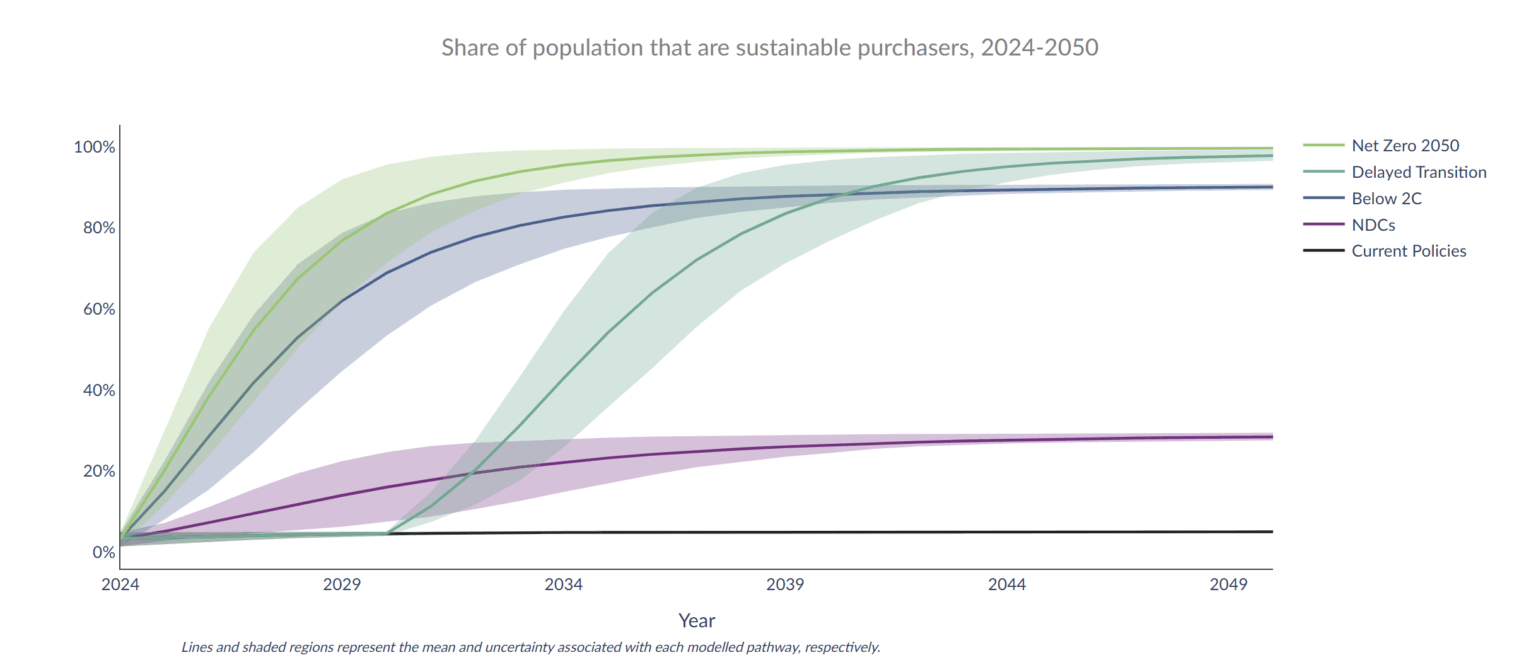

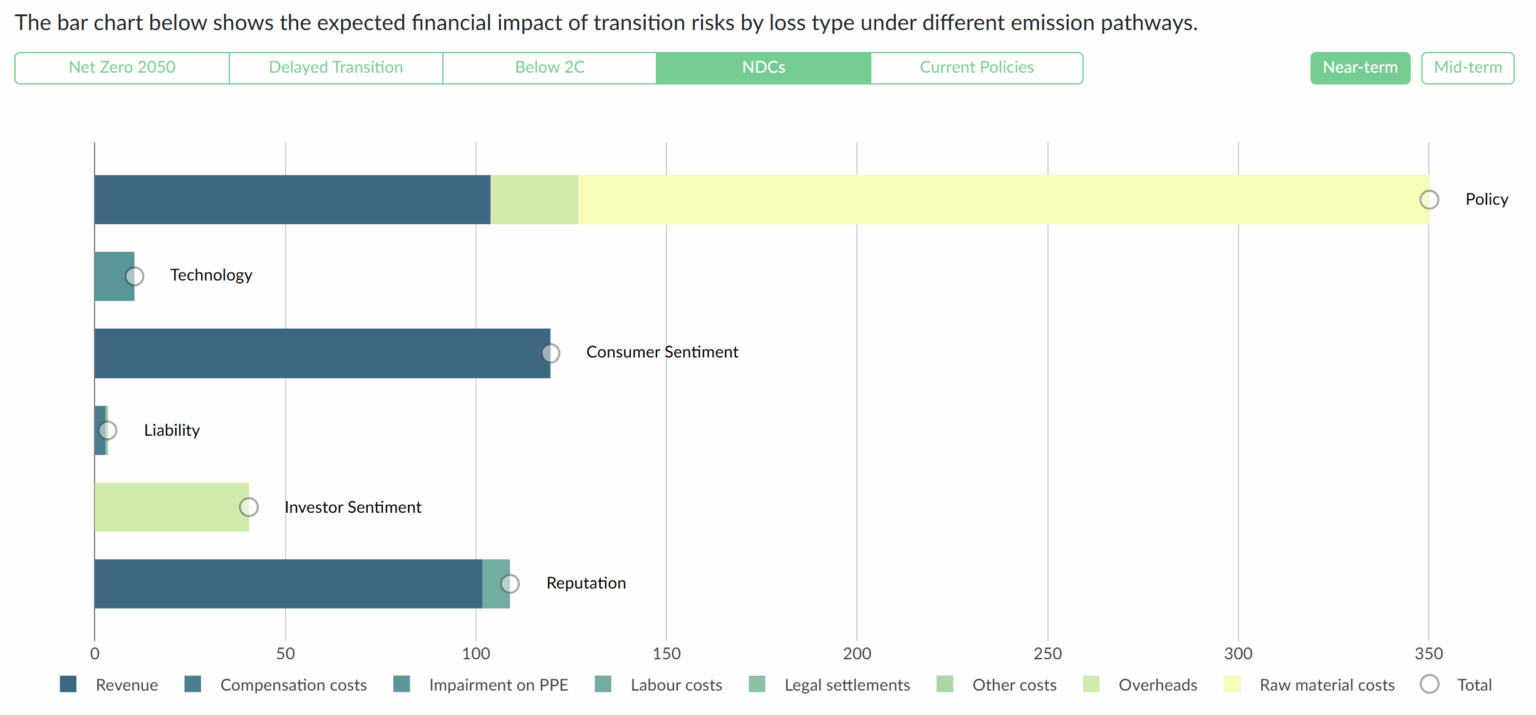

Scenario analysis

Australian regulators expect companies to use scenario analysis not just as a risk lens, but as a decision tool. This involves disclosing assumptions, uncertainties, and the financial effects of different warming pathways. Risilience can help you model the potential effects of these scenarios on your assets, liabilities and overall financial position, utilising scenarios derived from the Network for Greening the Financial System (NGFS). We supplement these scenarios with additional information on consumer trends and liability risks to provide a holistic understanding of potential business impacts, tying scenario analysis to financial flows and corporate strategy. Our tools provide the forward-looking insights necessary for robust disclosure.

Financial impact quantification

Risilience helps translate climate risks into tangible financial impacts. This step involves quantifying the potential financial implications of both physical and transition risks on your company’s revenue, costs, capital expenditures, asset valuations, and access to capital. Our analytics help you estimate these impacts, providing the data-driven insights needed to demonstrate the materiality of climate risks to investors and stakeholders, and to integrate these considerations into your broader financial planning.

Report on key metrics and targets

Risilience provides the relevant metrics used to assess climate-related risks and opportunities in line with your strategy and risk management processes. Our solution helps you identify meaningful targets and key metrics that can be used for reporting and tracking purposes, ensuring alignment with relevant SASB-derived metrics, per the ASRS disclosure recommendations.

Speak with a member of our team

Book a session with our team to understand how Risilience can leverage your organisation’s compliance to ASRS to deliver business resilience and ROI.

ASRS – FAQs

When does ASRS reporting start?

Mandatory climate reporting under the Australian Sustainability Reporting Standards (ASRS) begins with Group 1 entities from 1 January 2025. Implementation is staggered: Group 2 begins in July 2026 and Group 3 in July 2027, based on the size and structure of the reporting entity. The reporting obligation applies to financial years commencing on or after the relevant start date. For example: • An entity with a calendar year reporting cycle must begin ASRS disclosures for the financial year starting 1 January 2025 to 31 December 2025. It must submit reports alongside the annual financial report within three months of year-end. • An entity with a financial year reporting cycle must begin ASRS disclosure for the financial year starting on 1 August 2025 to 31 July. It must submit reports alongside the annual financial report within three months of the financial year-end. ASRS disclosures are due at the same time as annual financial statements and must be lodged with ASIC as part of the full reporting package.

Which companies are required to report?

ASRS applies to companies that are required to prepare financial reports under Chapter 2M of the Corporations Act 2001. This includes listed companies and many large unlisted entities, including foreign subsidiaries. Reporting is triggered if the Australian entity meets two of three size thresholds: consolidated revenue, gross assets, or employee headcount—all assessed at the Australian level.

Can a global parent company report on behalf of its Australian subsidiary?

No. ASRS requires a standalone, Australian-specific disclosure. Global reports, even if ISSB-aligned, do not fulfil the local obligation. An Australian entity must produce its own report based on domestic data, governance structures, and scenario analysis.

What disclosures are required under ASRS?

Companies must disclose governance, strategy, risk management, and metrics relating to climate risk. These are broadly aligned with IFRS S2. This includes Scope 1 and Scope 2 emissions, and eventually Scope 3, alongside scenario analysis, financial impact estimates, and transition and physical risk assessments.

What type of scenario analysis is required?

Companies must disclose governance, strategy, risk management, and metrics relating to climate risk. These are broadly aligned with IFRS S2. This includes Scope 1 and Scope 2 emissions, and eventually Scope 3, alongside scenario analysis, financial impact estimates, and transition and physical risk assessments.

What type of ASRS analysis is required?

ASRS mandates dual scenario analysis using a Paris-aligned (1.5°C) pathway and a high-warming (>2.5°C) scenario. Companies must disclose assumptions, inputs, and financial implications. Generic or boilerplate scenarios will not suffice; analysis must be tailored, decision-relevant, and supported by evidence.

Are directors liable for forward-looking statements?

Yes, but the ASRS regime includes safe-harbour provisions and modified expectations for inherently uncertain disclosures like Scope 3 emissions or scenario planning. Directors are protected when they act with due diligence and document appropriate oversight.

Is assurance required on ASRS disclosures?

Yes. ASRS introduces phased assurance requirements. Initially, disclosures must undergo limited assurance, escalating to reasonable assurance over time, starting with Scope 1 and 2 emissions, and extending to broader climate disclosures by 2030.

How does ASRS align with international standards?

ASRS is based on the International Sustainability Standards Board (ISSB) frameworks, specifically IFRS S1 and S2. Companies preparing for CSRD (EU), CFDR (UK), or SB 261 (California) rules will recognise overlapping requirements, but must still localise content for the Australian context.

Why household goods companies are struggling to turn sustainability into financial performance

Our offices

Let’s connect