Quantifying portfolio transition risks: the Risilience Earnings Value for Transition Risk Data File

In today’s investment landscape, understanding the financial impact of climate change is critical to strategic decision-making. Laurence Smith, Director of Financial Analytics at Risilience, sets out the benefits of taking a granular and forward-looking view of how transition risks impact corporate earnings.

As the global economy navigates a complex, disruptive and often unpredictable transition to a low-carbon future, asset managers face the critical challenge of identifying and quantifying the associated risks within their portfolios.

Securing a granular and forward-looking view of how transition risks impact corporate earnings can empower smarter, more resilient investment decisions.

What is the Earnings Value for Transition Risk (EVTR) Data File?

Providing a powerful lens to quantify transition risk, the Risilience Earnings Value for Transition Risk (EVTR) Data File supports investment firms to assess risks emerging from the transition to a low-carbon economy. Adams Street Partners TCFD Report 2024 showcases the capability of the File, which features:

Refreshed underlying data: the File is built on the latest available corporate data, including updated information on company financials, emissions and trade flows, ensuring the results represent today’s market.

Seven industry-standard NGFS Scenarios: Risilience covers all scenarios from the latest Network for Greening the Financial System (NGFS) update. A wider range of plausible futures, including ‘Disorderly’ and ‘Too little, too late’ transitions, offers more options to stress test portfolios.

Updated models: our Policy, Litigation, Market Investor, Reputation, Technology, and Market Consumer models reflect the latest observed trends and scientific methods.

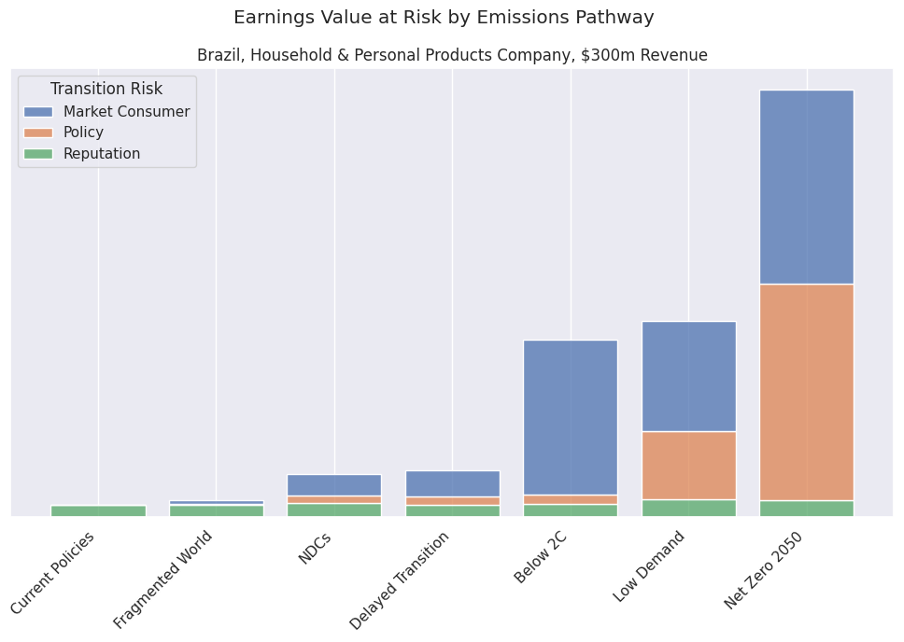

Figure 1 – A comparison of the three most material transition risks for a Brazilian Household and Personal Products company with a revenue of $300m. The size and relativity of the risks varies across pathways.

How much detail does the EVTR File deliver?

Quantified granular detail is built from a bottom-up approach. The EVTR file provides transition risk for 5,501 segments split by:

• Country of headquarters

• Global Industry Classification Standard GICS) industry group

• Company revenue band

Transition risk is quantified by:

• Five-year and 10-year Earnings Value at Risk (change in discounted cash flow)

• Transition risk type (policy, litigation, technology, market consumer, market investor and reputation)

• Future climate pathway (seven NGFS scenarios)

Risilience harnesses its expertise from providing detailed individual company analysis to leading corporates. Publicly available data is used to build digital twins for 28,000 listed companies around the world, which are then combined to form average companies by country, industry sector and revenue band. These average companies are then processed through Risilience’s transition risk models to produce the Earnings Value at Risk for each company; an effective approach that contrasts with top-down methods that do not take into account the nuances of each individual segment.

Figure 2 – A comparison of the six industries with the highest percentage earnings value at risk for very large German companies. Interestingly, the absolute risk for Automobiles and Components is lower than for Energy but because the underlying earnings value of energy is higher, the percentage earnings value at risk is higher for Automobiles and Components.

How does the EVTR Data File deliver value?

For asset managers, the EVTR File is more than just data; it provides a critical tool for navigating the evolving demands of clients and regulators by delivering financially quantified insights to inform investment decisions, ultimately turning risk into a strategic advantage.

The File allows climate transition risk to be estimated when either: detailed company information is unavailable (e.g. private company investments, funds of funds); there isn’t time to collect detailed information (e.g. pre-investment screening); or an initial view on materiality is desired before delving deeper into the highest risk companies.

The EVTR File supports asset managers to:

• Streamline global regulatory reporting

Provides the quantitative, scenario-based data needed to meet the requirements of major regulatory frameworks, including the ISSB/IFRS Sustainability Reporting Standards, the European Corporate Sustainability Reporting Directive (CSRD), Sustainable Finance Disclosure Regulation (SFDR), California’s SB 261 and the UK mandatory TCFD reporting.

• Quantify and rebalance portfolio risks

Quantifies financial risk and materiality outputs across portfolios, allowing analysts to examine risks and benefits under various future scenarios. This provides an enhanced understanding for the strategic rebalancing of portfolios across combinations of countries, sectors, and revenue sizes.

• Enhance strategic decision-making with granularity

Delivers exceptional granularity and resolution, empowering asset managers to achieve more than a holistic portfolio level risk assessment by drilling down into sectors, countries and revenue-bands. This capability helps asset analysts to pinpoint specific portfolio risk hotspots and make strategic decisions. The data identifies which risks are most pertinent at a sector level for collaboration and co-operation to achieve risk mitigation, and which segments of the portfolio are better suited for divestment.

Applying insights from the EVTR File enables a far more sophisticated, strategic approach to managing risk at the sub-portfolio level.

• Read more about how the EVTR file supports asset managers: Adams Street’s 2024 TCFD report.

• Learn more about how the EVTR Data File can transform climate risk analysis into strategic advantage. Connect with the Risilience team.

January 2026: New Risilience analysis shows climate-related transition risks are the most immediate threat facing global organisations.

Let’s connect

Find out more – talk to our advisors or book a

demo with Risilience