Product overview

Riise enables teams across an organisation to understand the financial implications of climate-and-nature-related risks and opportunities. With a unique capability to assess both physical, transition and nature risks through a single analytical lens, Riise turns complex data into clear, actionable strategies and measurable plans.

Evaluate the financial impact of climate and nature risks

Quantify > Strategise > deliver

Explore the benefits of the Riise platform

Riise benefit

Risk screening

Strategically manage exposure across a broad range of environmental and economic factors.

Transition risk

Understand the macroeconomic shifts that will impact companies as economies transition towards a lower carbon future. Leveraging NGFS-aligned climate pathways, our transition risk models cover policy and technology shifts, legal and reputational risks and changes to investor and consumer preferences.

Physical risk

Understand exposure to physical climate risks. Assess exposure to acute and chronic physical risk due to climate related events and the associated operational implications due to business interruption, infrastructure impairment and supply constraints. Model the long-term trajectory of climate change to inform strategic business decisions.

Nature risk

Understand impacts to and dependencies on nature through a double materiality perspective. Riise uses a TNFD-aligned methodology to capture both the company’s impact to and dependency on the natural environment, surfacing the financial implications emerging from nature-related risks, both physical (ecosystem collapse) and transition (regulation, market trends, reputational exposure).

Riise benefit

Digital twin insights

A dynamic and interconnected view of business performance equipping companies to evaluate climate-and-nature-related risks and opportunities across operations, portfolios, and the full value chain.

Capturing operational and commercial footprints

The Riise digital twin maps the commercial and physical structure of a company across operations, supply chains and customer segments. By linking these interconnected components, organisations gain a clearer understanding of how environmental risks spread through the business and how those risks affect financial and operational outcomes.

Business applications and strategic value

Digital twins offer strategic value across sectors by improving visibility, monitoring and forecasting across business-critical value chains. They enable companies to proactively explore different futures; testing assumptions, identifying vulnerabilities and quantifying upside opportunities with precision.

Enabling strategic decision-making

Modern businesses operate within highly interconnected ecosystems. Riise digital twins bring together fragmented datasets from across the business to create a unified, analytical view of climate-and-nature-related exposure. This connected view empowers executives to make informed, commercially-optimised decisions underpinned by robust scenario analysis and financial clarity.

Riise benefit

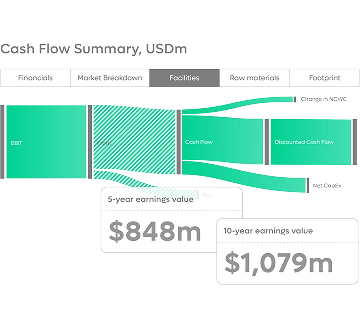

Financial quantification

Translate climate uncertainty into actionable financial intelligence.

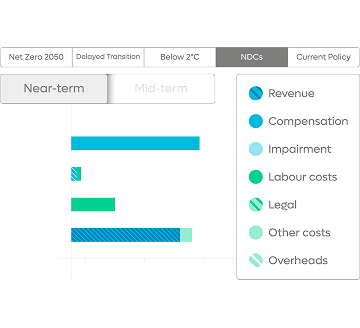

Scenario modelling

Riise simulates a full range of financial and market variables across different climate pathways including interest rates, inflation, carbon pricing, and sectoral demand shifts. These scenarios span short, medium and long-term timeframes and incorporate both physical and transition risk drivers.

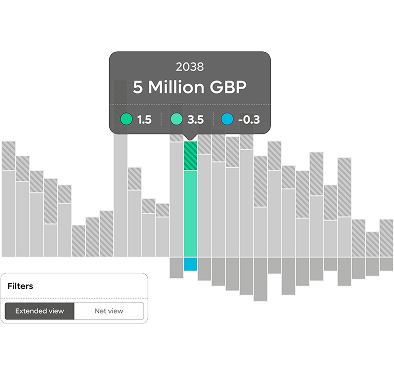

Stress testing

Riise enables modelling of low-probability, high-impact events including sudden regulatory changes or climate-related disasters that could significantly alter asset valuations and business continuity assumptions.

Transition risk

Riise quantifies the potential shocks to both cost structures and revenue generation stemming from transition factors. This includes exposure to evolving policy environments, investor expectations, litigation risk, market realignment, consumer preference shifts, and reputational pressures.

Physical risk

Riise provides granular, location-specific analysis of acute and chronic climate hazards delivering probability distributions for event return periods, estimated disruption levels, recovery timelines, and financial damages associated with extreme weather events and environmental degradation.

Riise benefit

Transition and mitigation planning

Build a commercially robust business case for emissions reduction through strategic transition planning.

Risk-adjusted decarbonisation

Identify, assess, and refine emissions reduction initiatives that optimise climate impact, mitigate risk exposure and maximise return on investment, providing a balanced and evidence-based approach.

Build shareholder and executive confidence

Develop business plans that are both costed and stress-tested under multiple transition scenarios, demonstrating transparency, alignment with corporate emissions targets and reinforcing credibility with the C-suite and investors.

Establish a competitive and sustainable market postition

Determine the optimal timing, scope and scale of decarbonisation investments to avoid under or over-commitment, maintaining financial resilience while meeting regulatory and market expectations.

Enhance internal alignment and collaboration

Use the platform’s integrated analytics and shared data environment to engage stakeholders across the business, driving consensus, accountability and cross-functional buy-in for climate strategy execution.

Let’s connect

Find out more – talk to our advisors or book a

demo with Risilience