Solutions

Financial institutions

Riise equips financial institutions across research, due diligence, advisory, portfolio management, and ESG/sustainability with the insights to assess and act on the financial implications of climate-and-nature-related risks and opportunities.

In today’s rapidly evolving world, climate and environmental factors are no longer external concerns but critical components of financial stability and investment performance.

At Risilience we specialises in providing cutting-edge climate and environmental risk analytics, data sets and tools to financial institutions, enabling seamless integration of these crucial considerations into investment strategies.

Who we help

We deliver granular, actionable analytics to support:

Private equity firms

Identify, assess, and manage climate and environmental risks within portfolio companies, driving sustainable value creation and mitigating potential liabilities.

Investment bank ESG advisory teams

Enhance advisory services with deep, data-driven insights into climate and environmental risks and opportunities for clients.

Private equity asset managers

Strengthen fiduciary duty by systematically incorporating climate and environmental risk into investment processes, optimising risk-adjusted returns, and meeting growing stakeholder demands for sustainable investing.

Riise

Financial solutions

riise solution

Banks

Investment bank ESG advisory teams are at the forefront of guiding clients through the complex and rapidly evolving sustainable finance. Riise provides differentiated and transparent data-driven insights on climate and environmental risk and opportunities that impact financial performance and long-term value.

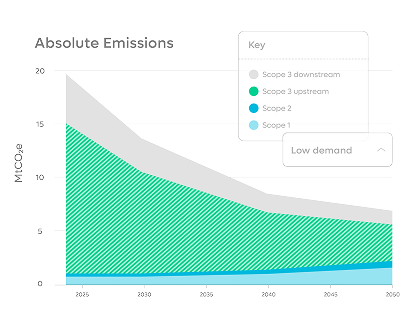

Quantifiable risk assessments

Beyond qualitative ESG scores, clients need to understand the financial implications of physical climate risks, such as asset damage from extreme weather, and transition risks, including stranded assets emerging from decarbonisation policies.

Deeper due diligence

Identify and assess specific environmental exposures within target companies or portfolios during M&A, capital raises or strategic advisory mandates.

Regulatory preparedness

Guide clients on evolving climate disclosure regulations, including ISSB, CSRD and TCFD climate-and-nature rules, and demonstrating compliance.

Strategic opportunity identification

Leverage climate and environmental trends to uncover new investment opportunities and enhance value creation.

Riise Solution

Private Equity

Private equity (PE) firms operate with a long-term investment horizon and a hands-on approach to value creation. Risilience provides comprehensive climate and environmental risk analytics tailored to the specific needs of private equity firms.

Mitigate financial risk

Mitigate financial risk

Proactively identify and quantify climate and environmental liabilities, preventing value erosion and protecting investor capital.

Strengthen LP relationships

Strengthen LP relationships

Meet and exceed LP demands for robust and transparent climate-and-nature related disclosures.

Unlock new value

Unlock new value

Identify and capitalise on opportunities for operational efficiency, growth in sustainable markets, and improved competitive positioning.

Fulfill fidicuary duties

Fulfill fidicuary duties

Ensure a comprehensive approach to risk management that includes forward-looking climate and environmental considerations.

Enhance deal flow and exit multiples

Enhance deal flow and exit multiples

Differentiate an organisation by demonstrating superior climate and environmental risk management, attracting LPs and commanding higher valuations at exit.

Build a future-proofed portfolio

Build a future-proofed portfolio

Invest in companies poised to thrive in a global economy increasingly shaped by climate change and sustainability imperatives.

Riise Solution

Asset management

Asset managers face increasing pressure to deliver strong, risk-adjusted returns while navigating a complex and rapidly evolving investment landscape.

Riise provides advanced climate and environmental risk analytics specifically designed to empower asset managers with comprehensive data and insights that integrate seamlessly with investment processes.

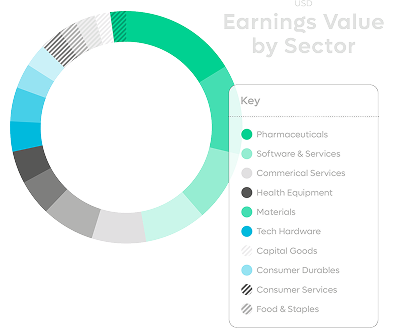

Enhance risk-adjusted returns

Enhance risk-adjusted returns

Identify and mitigate material climate and environmental risks that could otherwise erode value, while uncovering opportunities for growth in the green economy.

Drive regulatory compliance

Drive regulatory compliance

Proactively prepare for and meet increasingly stringent climate-and-nature-related financial disclosure and reporting requirements.

Build resilient portfolios

Build resilient portfolios

Construct portfolios better positioned to withstand future climate shocks and thrive in a decarbonising world.

Attract and retain capital

Attract and retain capital

Appeal to the growing investor demand for sustainable, climate-aware investment products and demonstrate leadership in responsible investing.

Meet fiduciary responsibilities

Meet fiduciary responsibilities

Demonstrate a comprehensive and sophisticated approach to identifying and managing all material risks, fulfilling duty to clients.

Gain a competitive edge

Gain a competitive edge

Differentiate offerings through superior climate and environmental risk intelligence and a forward-looking investment approach.

Let’s connect

Find out more – talk to our advisors or book a

demo with Risilience