From risk to ROI

solutions overview

We support corporates and financial institutions to quantify environmental impact with the Risilience-powered platform, Riise.

Where and how Risilience adds value

Data-driven insights

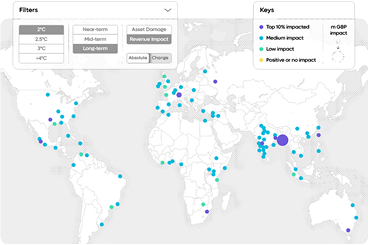

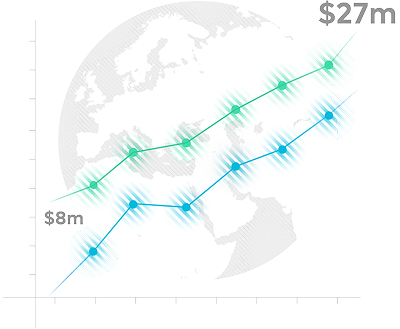

Riise turns complex environmental data into financially relevant insights, enabling strategies to be evaluated and adjusted by cost, impact, and ROI across both physical and transition risks.

Long-term value

Reducing exposure to climate and nature risks strengthens investor confidence, protects enterprise value, and opens new capital opportunities.

Credibility at scale

Through a data-driven digital twin, Riise delivers tailored, science-backed risk models that support planning, integration, and credible reporting.

Solutions

Feature |

Software/SaaS platform Riise |

Traditional consulting service |

|---|---|---|

Transparency and auditability |

No black box. Methodology and underlying climate models are visible, auditable, and defendable. |

Opaque. Methodology is often contained within the consultant’s proprietary models, making it difficult to audit the core assumptions. |

Speed and scalability |

Ready access to essential analysis and reporting. Automated tools streamline data ingestion and calculations, enabling faster decision-making. |

Time-bound analysis is manual, project-based, and scales linearly with time and cost. |

Update frequency |

Dynamic. Updates to models and data are immediately available for further analysis. |

Static. Analysis is a snapshot in time based on point-in-time data and models. |

Cost and ownership |

Predictable SaaS fee. Low total cost for recurring analysis. You own the data and the capability for continuous monitoring and scenario running. |

Expensive, one-off cost. The expertise leaves when the project ends, creating dependency for future updates. |

Flexibility |

Expert support as and when you need it. We partner with you to optimise your ROI. |

RIISE

Our solutions

Riise solution

Corporates

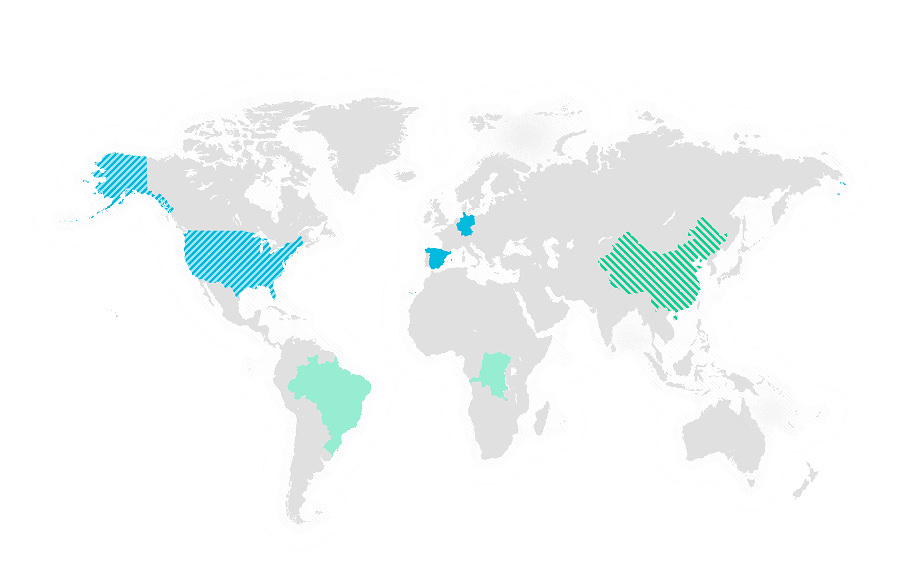

Riise delivers insights to support global corporate teams across finance, sustainability, and risk to quantify, strategise and deliver on company goals and objectives related to climate-and-nature-related risks and opportunities.

With a commercially-focused approach, Riise enables the assessment of financial materiality across short-, medium- and long-term horizons under multiple emissions scenarios. Our outputs are aligned with global reporting frameworks including TCFD, CSRD, TNFD, among others, ensuring regulatory readiness and strategic foresight.

Riise solution

Financial institutions

Riise equips financial institutions across research, due diligence, advisory, portfolio management, and ESG/sustainability with the insights to assess and act on the financial implications of climate-and-nature-related risks and opportunities.

Risilience specialises in providing cutting-edge climate and environmental risk analytics, data sets and tools to financial institutions, enabling seamless integration of these crucial considerations into investment strategies.

Let’s connect

Find out more – talk to our advisors or book a

demo with Risilience